INDIANAPOLIS — Two-year-old Teddy Thedwall and 7-year-old Emma Trendowski live hours apart, but they share a very similar story.

Both Indiana children got sick last summer. Both were transported to a hospital by ambulance. And both kids had shocked parents once their ambulance invoices arrived in the mail.

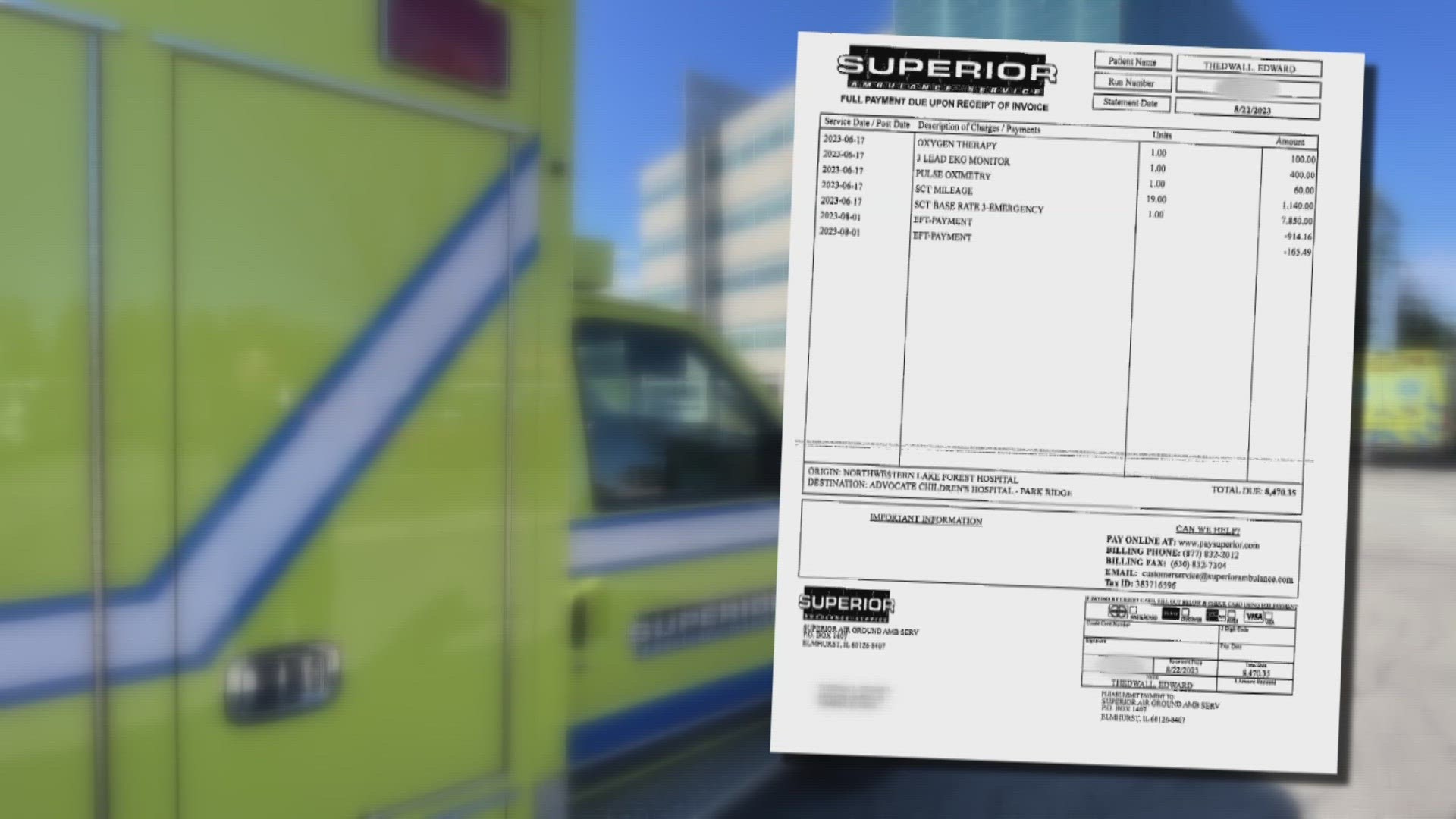

“The bill for the ambulance was $8,470,” Teddy’s mother, Erin, said from her Fishers home.

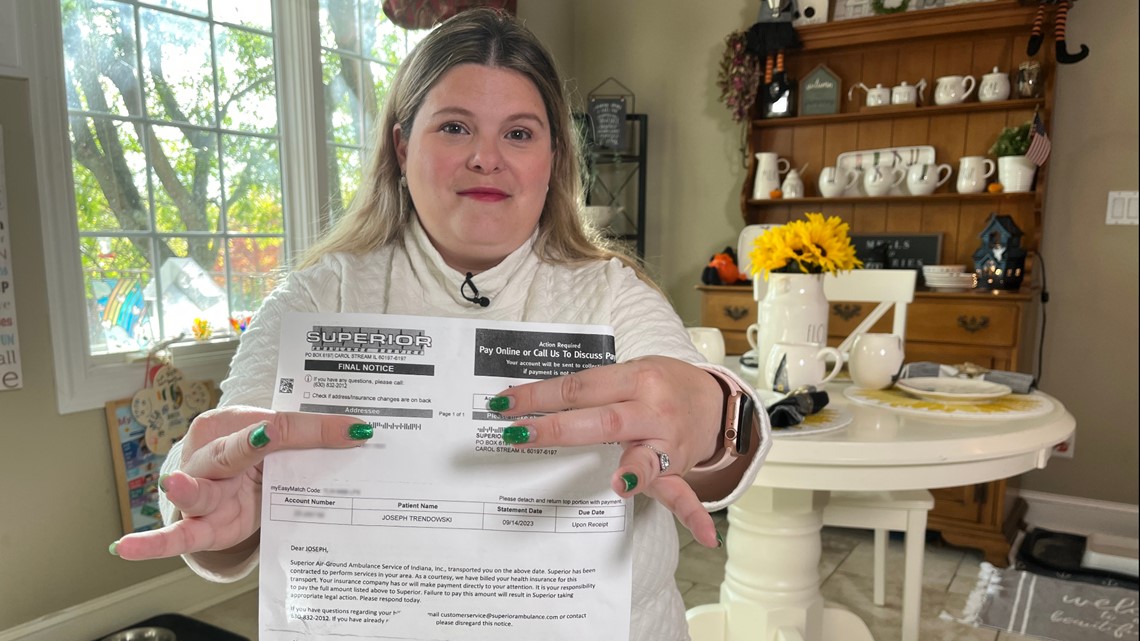

“It’s $9,076.04,” Stephanie Trendowski, of Crown Point, told 13 Investigates this fall, while pointing to the balance on her bill. ”It was shocking to see it was almost $10,000 to take my child 37 miles from one hospital to the other that we easily could have done ourselves.”

The families were not just surprised. They were angry.

“How is that even possible?” asked Teddy’s father, Ryan, who works as a 13News photojournalist. “It should never cost that much!”

The Thedwalls and Trendowskis are not alone.

A recent report by the Public Interest Research Group shows ambulances transport over 3 million Americans with private insurance every year, and more than half of those patients are exposed to a surprise bill. That surprise comes months later when insurance companies deny coverage because the emergency transport was provided by an out-of-network ambulance, leaving patients stuck paying the balance.

Those types of surprises are not supposed to happen.

Three years ago, Congress passed the No Surprises Act to protect consumers from surprise medical bills. Hospitals, clinics and air ambulances are covered by the law. But ground ambulances were not included in the No Surprises Act, sticking millions of Americans with surprise bills.

The Thedwalls eventually resolved Teddy's bill by appealing to their insurance company with the help of a private service.

But when it came to the Trendowski's surprise bill, neither the ambulance service nor the insurance company would budge at all. That changed after 13News broadcast Emma's story.

Reaching a settlement

13 Investigates contacted the Trendowski family’s insurance carrier and the ambulance company that transported Emma to better understand why the family was sent a $9,000 bill, despite having health insurance that’s supposed to cover ambulance transports. Each company blamed the other for the unresolved bill.

"We did our job, but the insurance companies didn’t do their job,” explained Superior Ambulance vice president Kim Godden, who said Anthem Blue Cross and Blue Shield agreed to pay only $334 of the Trendowski’s $9,410 ambulance bill. She said in recent years, Anthem and other private insurers have repeatedly declined to offer Superior fair rates or to negotiate in good faith for the company to be part of their in-network providers.

“If insurance isn’t going to cover an ambulance transport, what do you need insurance for?” Godden said.

But Anthem disagreed with the ambulance company’s assessment, alleging that private ambulance companies, such as Superior, charge unreasonably high rates.

Tony Felts, a spokesman for Anthem Blue Cross and Blue Shield — the company that denied the vast majority of Emma’s ambulance charges — told 13News:

“Superior charged (the Trendowski family) eight times what Medicare would have paid for the same service. For the last year, Anthem has talked with Superior Ambulance about joining our network so that our members would be protected from these inflated out-of-network charges. Unfortunately, despite our best efforts, they have chosen not to join the network.”

Felts claimed that Anthem had already asked Superior to waive or reduce the Trendowski’s charges, but he said the ambulance company “declined to do so.”

After 13News reported on the standstill and contacted both companies again to request a negotiated settlement, both Superior and Anthem agreed to a resolution. Stephanie Trendowski said she learned of the settlement in a phone call from Superior.

“I answered the phone, and she said, ‘I have great news for you. You have a zero balance now,’” Trendowski recalled. “And I said, 'That's wonderful. Is there anything else I need to do now going forward?' And she said, 'You're good to go. You have a zero balance.'”

Superior Ambulance said the settlement likely would not have happened without intervention from the media.

“After your story, Anthem reached out to us and said, 'We'd like to negotiate on this particular case,'” Godden told 13News. “They were finally willing to talk with us … and they increased their initial offer because I think they understood the importance of the transport after seeing your story.”

The negotiation resulted in Anthem approving a total payment to Superior that equals 400% of the rate that Medicare would approve for the same ambulance transport. That total rate – $4,521.08 – is nearly five times higher than Anthem originally agreed to pay Superior. (The insurance company originally approved $970 in payments to Superior, with $334 coming from Anthem and the Trendowski family paying the remaining $636 to meet their out-of-pocket deductible.)

Superior gladly accepted the $4,521.08 offer, telling 13 Investigates it would not seek any additional payment.

“The offer that they gave … is really what all rates should be at all times,” Godden told 13News. “Bottom line for the family, they have a zero balance with us.”

Why many ambulance bills are inflated

But if the ambulance company is satisfied to get $4,521 for an ambulance transport, why did it try to charge the Trendowski family and their insurance company more than twice that much?

“Certainty. We'll take what we can get,” Godden explained. “If we could guarantee we had a certain amount every time we transported a patient, then our bills would be less.”

Godden said ambulance companies often transport patients who have no insurance or who cannot afford their high co-pays and deductibles, and she said ambulance companies are constantly battling insurance companies that refuse to pay a fair reimbursement rate for their services. She said billing is based on the overall costs associated with maintaining a service that is available round-the-clock, while also taking into account the average payment they can expect based on the types of payers who are being billed.

That's why some ambulance bills are inflated: to help compensate for patients who cannot or will not pay anything, and for government agencies and private insurance companies that pay below-market reimbursement rates.

Anthem and other insurance companies are hesitant to pay inflated charges. When they refuse to pay and won't negotiate a more reasonable rate, unsuspecting families like the Trendowskis are often left to pay large balances for ambulance transports despite paying their monthly insurance premiums.

“The EMS system in the state of Indiana is very fragile right now, and this story brings to light, ‘Hey, why do we need news stories to have fair reimbursement?’” said Godden, who also sits on the Indiana EMS Association board of directors. “This is a bigger issue than this particular case. There are many other families in the same situation as the family in your story.”

At least for the Trendowski family, their ambulance bill is now resolved. Well, almost resolved.

After Superior Ambulance called to say their $9,000 bill was considered paid, the family got another surprise.

“And not even 24 hours later, I get a call from a third-party collection agency saying that Superior turned me in to collections,” Stephanie Trendowski said. “Just when you think it’s over, it’s not.”

Superior told 13 Investigates that turning the bill over to collections was a mistake, and the ambulance company said it would contact the agency to resolve it.

No more surprises?

A federal advisory committee is now working to help prevent other families from experiencing the same frustrations that the Trendowski and Thedwall families faced for months.

Just days after 13News aired its investigation, the Advisory Committee on Ground Ambulance and Patient Billing (GAPB) met in Washington, D.C. The committee approved 21 recommendations related to ambulance billing, and in the coming weeks, the committee will send a report to Congress recommending that federal lawmakers adopt its recommendations into law.

Among the recommendations:

- Amend the No Surprises Acts to ban the practice of surprise ambulance billing for consumers.

- Patients should be charged no more than $100 for an ambulance transport with insurance companies paying the rest.

- Ambulance and insurance companies should establish fixed reimbursement rates for ambulance transports that will be more fair and predictable for both parties.

The committee’s extensive list of recommendations to Congress along with its voting summary can be found on the committee webpage.

How to avoid surprise medical bills

Despite new laws meant to protect consumers against many types of surprise bills, medical billing can still be hard to understand and not very transparent. Knowing the resources that are available and the right questions to ask can go a long way in helping to reduce your risk of getting a surprise bill.

Ask the right questions

These three questions will help you determine if you are at risk for a surprise medical bill:

- Is my doctor or medical specialist in-network? (Yes = lower health care costs)

- Will I receive services from anyone else during my procedure who is not in-network? (Yes = higher health care costs)

- Is the facility in-network? (Yes = lower health care costs)

Whenever possible, get the answers to these questions in writing.

It's important to use the term “in-network” when asking these questions. While a doctor or facility might “accept” your insurance, that does not necessarily mean they accept your specific plan.

These questions also need to be asked every time you receive health care. Many plan providers change from one year to the next, and a doctor who might be in-network this year could be out-of-network in a couple of months.

Starting in January 2022, medical providers and facilities were required to notify you of any out-of-network practitioners who will be providing your health care and obtain your permission before they can seek reimbursement for higher out-of-network rates.

Request a good faith estimate

In many situations, state and federal laws require health care providers and facilities to provide a good faith estimate to patients – as long as you request one. In some situations, those good faith estimates are required, whether requested or not.

If you are legally entitled to an estimate, ask for one, and do as soon as possible. Make sure to request a good faith estimate at least five business days prior to your procedure (providers do not have to provide an estimate if given less notice) to catch potential surprises before you receive your medical care. Realizing that you may receive services from an out-of-network provider before your procedure gives you an opportunity to reschedule the medical care at a different facility that might not use out-of-network providers, costing you much less.

Use online price tools

Indiana hospitals are now legally required to provide an online list of prices for their most common procedures. Checking those price estimator tools allows patients to shop around for prices, which is especially valuable for those who are uninsured or planning to pay for health care services out of pocket.

The non-binding estimates often include a series of disclaimers, including warnings that estimates may not include out-of-network provider charges and various support services required during procedures. Insured patients may find it more difficult to get an accurate estimate without calling a health care facility directly to provide more detailed insurance information. Nonetheless, the price estimator tools are a positive step toward medical billing transparency.

You can usually find price estimates online by typing the name of a specific hospital network and the term “price estimator” into a search engine.

In an emergency

Air ambulances are covered by the No Surprises Act, but ground ambulances are not. In an emergency, you won’t have time to shop around for an in-network ambulance, and according to Kim Godden of Superior Ambulance Service, nearly 75% of ground ambulance services nationwide are out-of-network anyway.

If you receive an ambulance bill that was denied by your insurance company, appeal the denial with your insurance carrier and, if need be, appeal to the highest level within the company. If the bill is still denied, you can file a complaint and submit an appeal to the Indiana Department of Insurance. Many ambulance companies also offer payment plans and discounts for families who need financial assistance with bills that are not covered by insurance.

Patricia Kelmar, of the Public Interest Research Council, recommends that consumers who cannot afford their ambulance bill should not pay the invoice with a credit card. She says many states offer consumers greater protections for medical debt than for consumer debt, and once an ambulance bill is switched over to a credit card, it becomes consumer debt.