FISHERS, Ind. — When Teddy Thedwall celebrated his second birthday last weekend – surrounded by family and friends at a park in Fishers – the gathering was emotional.

Everyone at the party knew how the toddler had spent much of his summer, and that a second birthday had been far from certain.

“It was completely shocking to go from a happy, playful, almost 2-year-old boy to just seeing him lying there on a ventilator,” Erin Thedwall, Teddy’s mother, told 13News.

“He was near death. It was bad,” added his father, Ryan, a longtime photojournalist at WTHR. “I remember waking up in the morning just feeling empty inside. For a while, we didn’t know which way things were going to go.”

The life-threatening scare started while the Thedwalls were on vacation, visiting family in Chicago. First a cough. Then trouble breathing. When Ryan tried to rock Teddy to sleep, it was clear something was very wrong.

“You could just feel his heart just absolutely thumping like crazy, fast like a hummingbird. That’s when we realized he needs to go to the hospital,” his father said.

But the pediatric ICU at Northwestern Lake Forest Hospital was full. Emergency room staff told the Thedwalls an ambulance had been called to transport Teddy to Advocate Lutheran General Hospital 19 miles away. Erin rode in the ambulance with her son, who was provided oxygen to help him breathe.

“At that point, Teddy was in the back watching 'Mickey Mouse Club' and laughing. We stopped at every red light, went the speed limit. It was just like driving in the car,” Erin explained.

Over the next few days, Teddy got worse. A lot worse.

A virus had attacked the toddler’s lungs, causing them to fail. Respiratory specialists in the ICU decided to put Teddy on a ventilator to help him breathe. When his condition declined further, Teddy’s doctors made a risky choice to induce a coma and to put him on life support – a last chance attempt to give his small lungs a chance to rest and recover.

It worked.

After nearly a full month in the ICU, Teddy left the hospital and returned to Indiana.

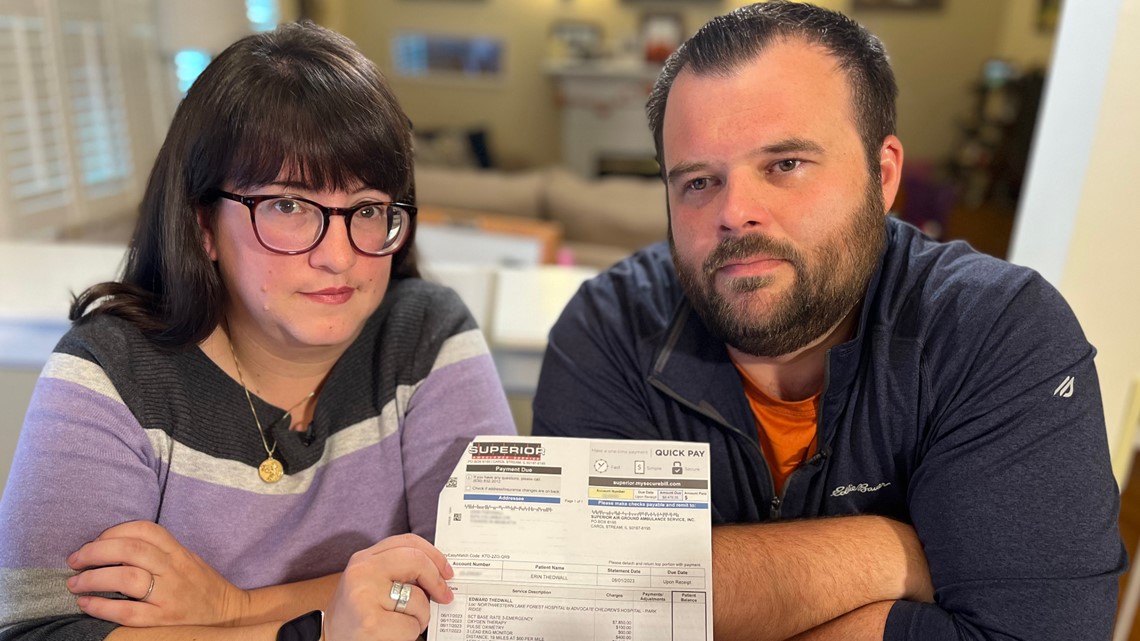

That’s when the Thedwall family discovered a new challenge: fighting a huge ambulance bill that had been denied by their insurance company. It’s the kind of surprise that impacts hundreds of thousands of unsuspecting Americans every year – despite a federal law that’s supposed to protect consumers from surprise medical bills.

Insurance denials = shocking balances

The bill for Teddy’s ambulance transportation was $9,550. The Thedwalls assumed that bill would be covered by insurance since the family has what Erin describes as “really good insurance” through her employer and had already met all of their out-of-pocket limits and insurance deductibles following Teddy’s monthlong hospital stay.

Their assumption was wrong. The insurance carrier, Aetna, paid Superior Ambulance Service only $1,079.65. The ambulance company sent the Thedwalls an invoice for the remaining $8,470.35, with a note stating “full payment due upon receipt.”

Teddy’s parents say they were never told the ambulance was outside their insurance network and were given no choice about which ambulance service would transport their son.

“When you’re in the hospital and your son is in the ER getting transferred to the ICU, the in-network nature of the ambulance is not the first thing that crosses your mind,” Ryan said. “At the time, didn’t even give it a second thought.”

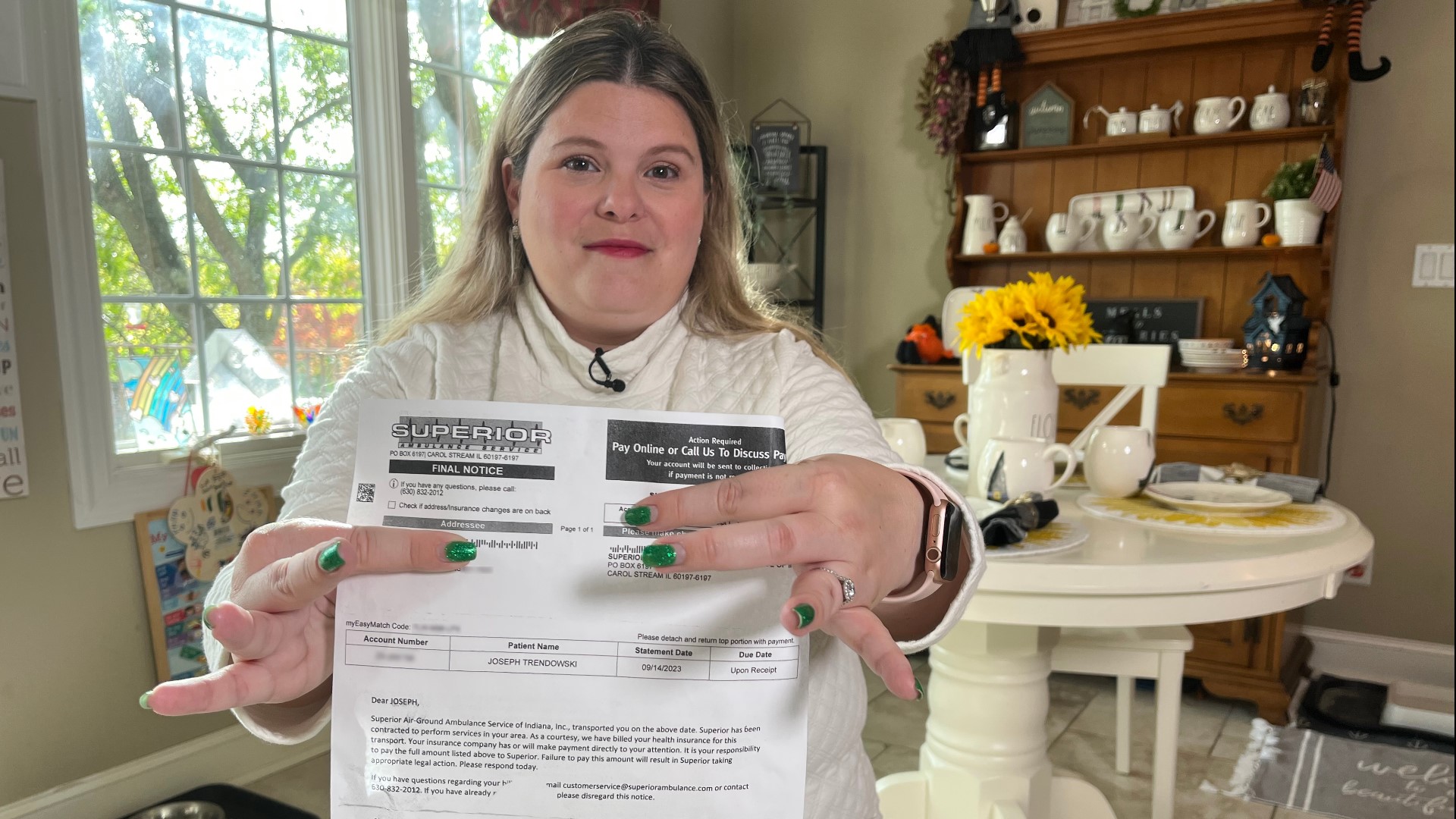

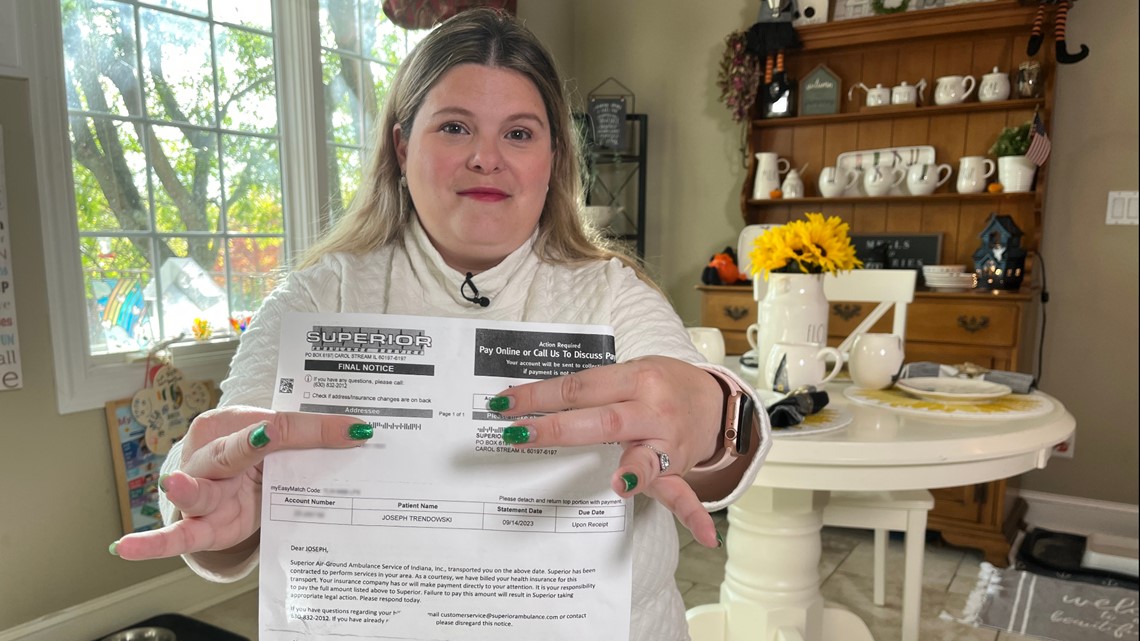

Stephanie Trendowski said the same thing happened to her.

“I got a final notice in the mail: $9,076.04,” she said, holding a bill she received from Superior Ambulance Service. “I just couldn’t believe it.”

The ambulance invoice is for her daughter Emma, who suffered a sudden attack of diabetes in June. When Trendowski took Emma to the closest hospital to their Crown Point home, doctors said they would need to send her to Comer Children’s Hospital in Chicago instead.

“They said it has to be in an ambulance. They would not allow us to take her in our own vehicle, even though she was stable at that point in time, so we waited five hours for a transport to be available,” Trendowski said.

Emma, who still recalls her first ride in an ambulance, described the transport between hospitals as an adventure. For her mom, it has turned into an ordeal.

The total ambulance bill for $9,410 was promptly rejected by the family’s insurance company, which agreed to pay only $333.96 for the out-of-network ambulance. The remaining $9,076.04 is now the responsibility of the Trendowski family.

“It was shocking to see it was almost $10,000 to take my child 37 miles from one hospital to the other that we easily could have done ourselves,” she told 13News.

The Trendowskis and Thedwalls are among millions of families across the nation facing the same dilemma.

Millions of families at risk

A recent report by the Public Interest Research Group shows ground ambulances transport over three million privately insured Americans every year, and over half of the patients are exposed to a surprise bill.

The surprise comes weeks or months after the ambulance service is provided, when insurance companies deny coverage because the ambulance service was out-of-network. Patients and their families are then stuck paying the balance.

“That’s outrageous,” Ryan Thedwall said of the $9,000 “balance bill” his family received. “The first problem is they charge upwards of $10,000 for a 19-mile ride. The second problem is they’re allowed to do it.”

To underscore his point, Teddy’s father explained that his son’s 29-day hospital stay in a pediatric ICU with round-the-clock nursing care, a team of medical specialists, and ventilators and other advanced medical equipment resulted in total costs of approximately $900,000, or $1,300 per hour for all of the medical services.

By comparison, he said, the ambulance transport that required roughly two hours of time, personnel and equipment cost nearly $5,000 per hour. The ambulance bill was the largest uncovered expense following Teddy’s monthlong hospital stay.

“How is that even possible?” Ryan asked. “It should never cost that much.”

The PIRG report calls for nationwide protections against ground ambulance surprise billing – the same kind of protections that already exist for many other types of medical services.

Those protections were approved three years ago when Congress passed the No Surprises Act to protect consumers from surprise medical bills. The law, which begins on page 1577 of the massive Consolidated Appropriations Act of 2021, took effect in early 2022 and offers patients comprehensive protections that include:

- Prohibiting health care providers from billing patients for more than the in-network cost-sharing included in patients’ insurance plans for nearly all health care services, including both elective and emergency care as well as transport by an air ambulance (ground ambulance transport is an exception)

- Requiring health plans to consider out-of-network services as in-network when calculating patients’ share of costs

- Establishing an arbitration process to settle disputes between out-of-network providers and insurance companies

But while hospitals, medical clinics, emergency rooms and air ambulances were all included in the No Surprises Act, ground ambulances were not - sticking millions of Americans who need an ambulance with a surprise bill.

“Everyone knows ambulances are expensive. You don’t a get a choice. The ambulance that shows up shows up. Why wouldn’t it be covered?” asked a frustrated Erin Thedwall.

“It feels like a cop out, like they just didn’t want to deal with an issue, so they just left it out,” added her husband, Ryan.

By excluding ground ambulances from the No Surprises Act, Congress chose not to mess with an already messy system. Some ambulances are operated by hospitals, some by cities and towns, others by private companies – all with a patchwork of local and state laws that impact rates and reimbursements.

With no national law or regulation system, it’s up to ambulance companies and insurance companies to figure things out. And that can get ugly.

Lots of finger pointing

Superior Ambulance, the company that transported both Teddy and Emma, stands by its rates and says the $9,000 for each transport is justified because of the high level of care and equipment provided, the distance traveled, and rising labor and fuel costs.

“The two cases you brought to us were specialty care level, so that was an advanced scope,” said Kim Godden, Superior Ambulance’s vice president of legal, government relations and corporate compliance. “These are basically mobile intensive care units.”

Godden told 13News her company has tried for years to work with insurance companies to prevent patients from getting caught in the middle of billing disputes, but she said some insurance companies simply won’t work with ambulance services to negotiate appropriate reimbursement rates.

She pointed specifically to the charges that Anthem Blue Cross and Blue Shield denied for Emma Trendowski’s ambulance. Godden said the $333.96 that the insurance company agreed to pay was even less than what Medicaid would have paid for the same transport across state lines. She said in recent years, Anthem has repeatedly declined to offer Superior Ambulance Service fair rates or to negotiate in good faith for the company to be part of its in-network providers.

“We did our job but the insurance companies didn’t do their job,” she said, referring to the insurance companies that sent large bills to the Thedwall and Trendowski families. “If insurance isn’t going to cover an ambulance transport, what do you need insurance for? All we want is fair negotiations. It’s America. We want fair negotiations. We shouldn’t be taken advantage of.”

But Anthem disagreed with the ambulance company’s assessment, alleging that private ambulance companies such as Superior are the ones who are taking advantage by charging exorbitant rates.

Tony Felts, a spokesman for Anthem Blue Cross and Blue Shield, the company that denied the vast majority of Emma’s ambulance charges, told 13News:

“Superior charged [the Trendowski family] eight times what Medicare would have paid for the same service. For the last year, Anthem has talked with Superior Ambulance about joining our network so that our members would be protected from these inflated out of network charges. Unfortunately, despite our best efforts, they have chosen not to join the network.”

The finger pointing helps explain why so many patients get surprise ambulance invoices, triggered by unresolved billing disputes that happen all over the country, every day, with consumers caught in the middle.

Looking for solutions

While Congress did not address surprise ambulance bills in the No Surprise Act, it did create a federal advisory committee to study the problem. Patricia Kelmar, who authored the PIRG study that examines the high cost of ambulance surprise bills, is a member of the committee.

“We are going to be working with Congress, sharing the report and really asking for strong protections and to do it quickly,” she told 13News.

The committee is scheduled to meet several times over the next two weeks before sending its recommendations to lawmakers, and Kelmar said without a new federal law to protect consumers, many private ambulance companies are now free to charge whatever the want.

“I’m seeing mileage rates from $12 per mile to $90 per mile. Can it really cost that much different from one community or one state to another? No!” she said. “One thing’s for sure. Those who are overbilling, when we solve this problem, they will be stopped from overbilling.”

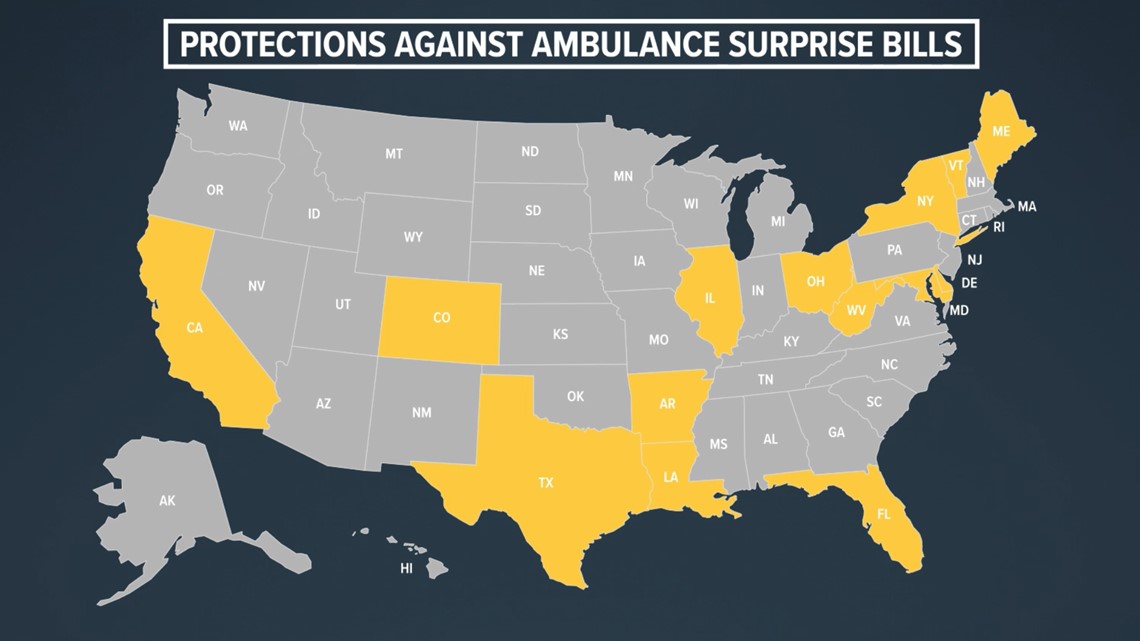

Some parts of the country are not waiting for a federal law to address surprise ambulance bills. Currently, 14 states (and some large cities) have passed their own laws to protect consumers from surprise billing by ambulance services. Indiana is not one of them - at least not yet.

“This is really important for Indiana,” said Kelmar, who supports efforts to address the problem on a local level. “You have neighbors on both sides of you – Illinois and Ohio – they are both protecting patients from ambulance surprise billing, so there’s a nice big gap in the middle there and we’d love to see some kind of action on a state level to protect patients from ambulance surprise bills.”

Godden, the Superior Ambulance executive who also sits on the Indiana EMS Association board of directors, said Indiana lawmakers passed a law last year that requires insurance companies to negotiate fair rates with ambulance services, thereby avoiding surprise billing. She said most insurance companies have not yet engaged with ambulance services to negotiate those fair rates.

“It’s disappointing,” she told 13News. “That’s what puts the patients in the middle.”

Stephanie Trendowski said that’s exactly the situation her family is dealing with. Superior and Anthem appear to be at a standstill over the $9,076 remaining balance on Emma’s ambulance bill.

Superior told 13News Wednesday afternoon that it had contacted the Trendowski family to assist with an appeal and that it had been in touch with Anthem about the dispute. “We let them know that we are interested in pursuing fair negotiations,” Godden said.

A report from Anthem on Thursday indicated the negotiations were not going well.

“Yesterday, we contacted Superior on our member’s behalf and asked that they consider waiving or reducing the charges, as most providers are often willing to do. But in this case, they declined to do so,” an Anthem spokesman told 13News.

After spending nearly 30 hours over the past two months trying to negotiate a resolution, the Thedwalls have had much more success resolving their ambulance bill.

With the help of a private company that helps consumers appeal insurance denials, Erin said Aetna recently changed its mind and negotiated a full settlement with Superior Ambulance. Aetna agreed to pay a total of $8,117 for Teddy’s ambulance transport, and Superior has since closed out the Thedwall’s account and marked it paid in full.

“I cried. I cried out of happiness that we got it covered. We got lucky. Really lucky,” Erin said.

How to avoid surprise medical bills

Despite new laws meant to protect consumers against many types of surprise bills, medical billing can still be hard to understand and not very transparent. Knowing the resources that are available and the right questions to ask can go a long way in helping to reduce your risk of getting a surprise bill.

Ask the right questions

These three questions will help you determine if you are at risk for a surprise medical bill:

- Is my doctor or medical specialist in-network? (Yes = lower health care costs)

- Will I receive services from anyone else during my procedure who is not in-network? (Yes = higher health care costs)

- Is the facility in-network? (Yes = lower health care costs)

Whenever possible, get the answers to these questions in writing.

It's important to use the term “in-network” when asking these questions. While a doctor or facility might “accept” your insurance, that does not necessarily mean they accept your specific plan.

These questions also need to be asked every time you receive health care. Many plan providers change from one year to the next, and a doctor who might be in-network this year could be out-of-network in a couple of months.

Starting in January 2022, medical providers and facilities were required to notify you of any out-of-network practitioners who will be providing your health care and obtain your permission before they can seek reimbursement for higher out-of-network rates.

Request a good faith estimate

In many situations, state and federal laws require health care providers and facilities to provide a good faith estimate to patients – as long as you request one. In some situations, those good faith estimates are required whether requested or not.

If you are legally entitled to an estimate, ask for one, and do as soon as possible. Make sure to request a good faith estimate at least five business days prior to your procedure (providers do not have to provide an estimate if given less notice) to catch potential surprises before you receive your medical care. Realizing that you may receive services from an out-of-network provider before your procedure gives you an opportunity to reschedule the medical care at a different facility that might not use out-of-network providers, costing you much less.

Use online price tools

Indiana hospitals are now legally required to provide an online list of prices for their most common procedures. Checking those price estimator tools allows patients to shop around for prices, which is especially valuable for those who are uninsured or planning to pay for health care services out of pocket.

The nonbinding estimates often include a series of disclaimers, including warnings that estimates may not include out-of-network provider charges and various support services required during procedures. Insured patients may find it more difficult to get an accurate estimate without calling a health care facility directly to provide more detailed insurance information. Nonetheless, the price estimator tools are a positive step towards medical billing transparency.

You can usually find price estimates online by typing the name of a specific hospital network and the term “price estimator” into a search engine.

In an emergency

Air ambulances are covered by the No Surprises Act, but ground ambulances are not. In an emergency, you won’t have time to shop around for an in-network ambulance, and according to Kim Godden of Superior Ambulance Service, nearly 75% of ground ambulance services nationwide are out-of-network anyway.

If you receive an ambulance bill that was denied by your insurance company, appeal the denial with your insurance carrier and, if need be, appeal to the highest level within the company. If the bill is still denied, you can file a complaint and submit an appeal to the Indiana Department of Insurance. Many ambulance companies also offer payment plans and discounts for families who need financial assistance with bills that are not covered by insurance.

Patricial Kelmar of the Public Interest Research Council recommends that consumers who cannot afford their ambulance bill should not pay the invoice with a credit card. She said many states offer consumers greater protections for medical debt than for consumer debt, and once an ambulance bill is switched over to a credit card, it becomes consumer debt.