INDIANAPOLIS — As state lawmakers begin work on a long-term plan to improve Indiana’s tax system in the coming years, it has become increasingly clear which tax Hoosiers say needs reform.

“Property taxes are totally out of control,” said Rob Kendall earlier this week on his WIBC radio program, "Kendall and Casey." The pair dedicated a segment of their morning talk show to the issue and read emails from homeowners who complained about year-after-year increases in their tax assessments.

“You are not alone on what you’re feeling with this property tax thing,” Kendall said.

They sure aren’t.

Last year, experts say Indiana homeowners were hit with a significant increase, up 17% on average. And with home values and assessments still on the rise, 13News heard from others who say their tax assessments rose for a second and third year in a row.

“My mom’s went up $1,200. She lives in Indy and is on a fixed income. Not good,” one Hoosier said.

Out of 33 constituent surveys sent out by Republican state senators to their respective districts this year and obtained by 13News, 27 asked which tax “would you most like to see Indiana reduce/eliminate in the future?”

About 48% chose property taxes, followed by 27% who selected income tax. Down the list was gas tax and state income tax.

Sen. Cyndee Carrasco represents District 36, which includes southern Marion County. She asked her constituents “which one of these taxes is the biggest burden for you and your family?”

Of the responses, 367 selected the property tax, and 137 chose income tax. A few dozen people each chose gas, sales and “other.”

"People feel it,” said Rep. Cherish Pryor, a Democrat who represents District 94 in Marion County and is the chief deputy for the Marion County Treasurer’s Office. She says it's past time for lawmakers to take action.

“The doubling and tripling for people on fixed incomes or low income individuals ... it’s pushing them out of their homes, and nobody should ever be forced to move out of their house because they can't pay their property taxes,” Pryor said.

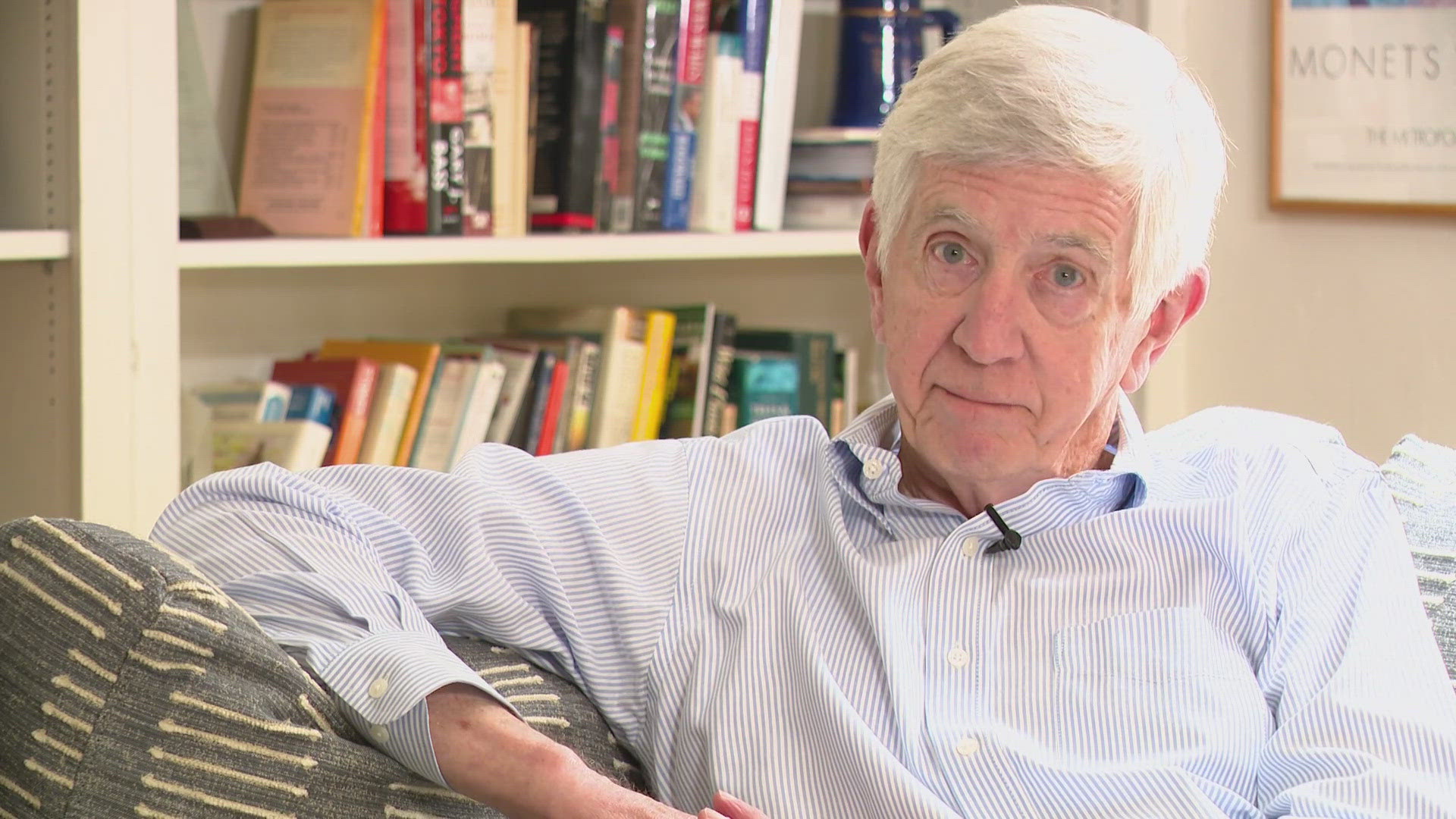

“That's a real problem,” said Ed Delaney, a Democrat who represents District 86 in Marion County and also serves on the House Ways and Means Committee. “It's one thing to be unhappy about paying it. It's another thing if you can't pay.”

Delaney said reforms nearly two decades ago worked well but “they can only work so long, and problems creep up.”

Those reforms capped most residential property taxes with a homestead exemption at 1% of their assessed value. Other residential properties were called at 2%, and 3% for commercial properties.

“We're going to have to make some adjustments,” Delaney said.

Delaney said he was particularly bothered by lower-income and rural communities where municipal needs remain high, but the “tax capacity” just isn’t there.

RELATED: Police, housing advocates discuss issues that could factor into the upcoming Indiana election

“We need to take a look at state subsidies for the districts that don’t have … tax capacity issues,” Delaney said. “They just don’t have the real estate values, but they’ve got the problems.”

Property taxes pay for a community’s essentials: police and fire protection, keeping the streets paved and plowed, and the garbage and recycling picked up. So what would property tax reform look like and how would municipal services be affected? That’s the question lawmakers will look to answer.

"We have to look at this holistically to resolve the problem,” Pryor said. “Until we do, we're going to tinker and shift around, and somebody's going to be hurt much more.”

Some have suggested using the state budget surplus to ease the burden on taxpayers. Other ideas include limiting how fast your assessment can grow each year and freezing property taxes for seniors.

"I think it's something that we can study to see the feasibility,” Pryor said.

13News made multiple requests for more than a week to speak with Rep. Jeff Thompson, who chairs the House Ways and Means Committee. A spokesperson said he couldn’t be available.