INDIANAPOLIS — All three candidates running for Indiana governor told 13News addressing property taxes will be a top priority in their administration.

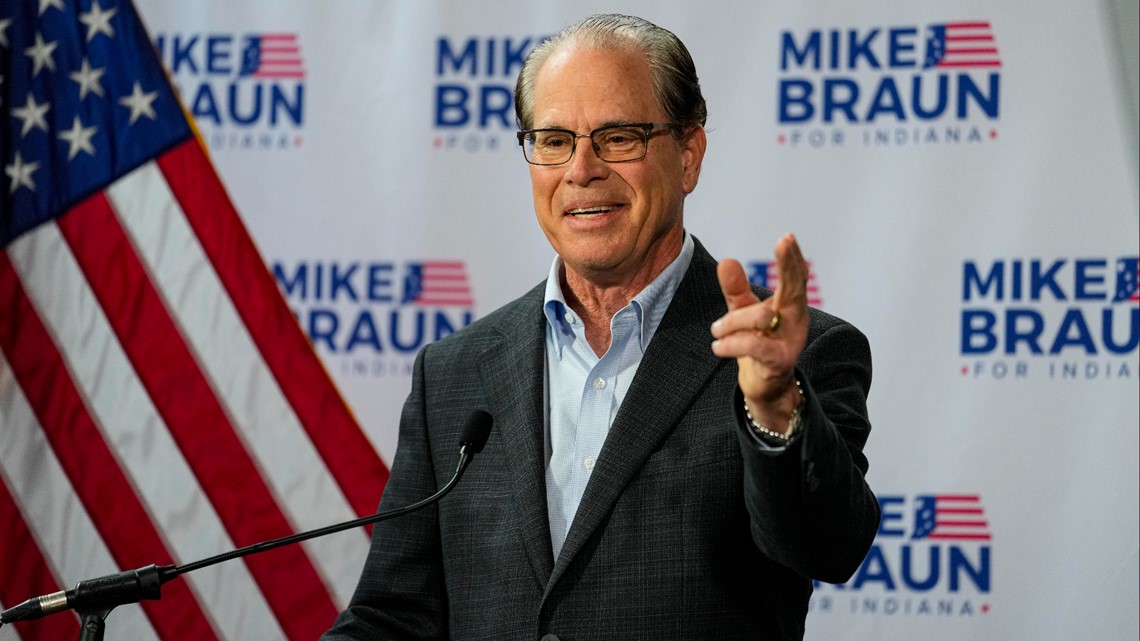

"I'd say that's the number one issue. That's what I've heard the most about," said Sen. Mike Braun, who is running on the Republican ticket. Braun has proposed overhauling the property tax deduction, which he says would result in an immediate 21% reduction in average homeowner tax bills. The Braun campaign has proposed capping future increases in tax bills at 2% for seniors, low-income Hoosiers and families with children. Others would see a 3% cap.

"Mine is very common sense," Braun said. "Don't grow taxes at a rate faster than the robust growth of your economy."

If any community wants more than that, Braun said local governments should be required to ask through a referendum only during high-turnout elections.

"Day one, we (would) go in, it's ready to go, the language is written, fiscal impact is written and figured," Democratic challenger Jennifer McCormick said. Her plan would include capping increases at 10%. She's proposing a 150% increase in exemptions on personal income, a 40% increase in the Homeowner Property Tax Deduction, and expanded deductions for senior citizens, disabled veterans and renters.

"We tried to roll that out, though, weighing you still have to have amazing quality services at the local level. So we didn't want to cripple our towns and our cities, but also we wanted to have relief for Hoosiers," McCormick said.

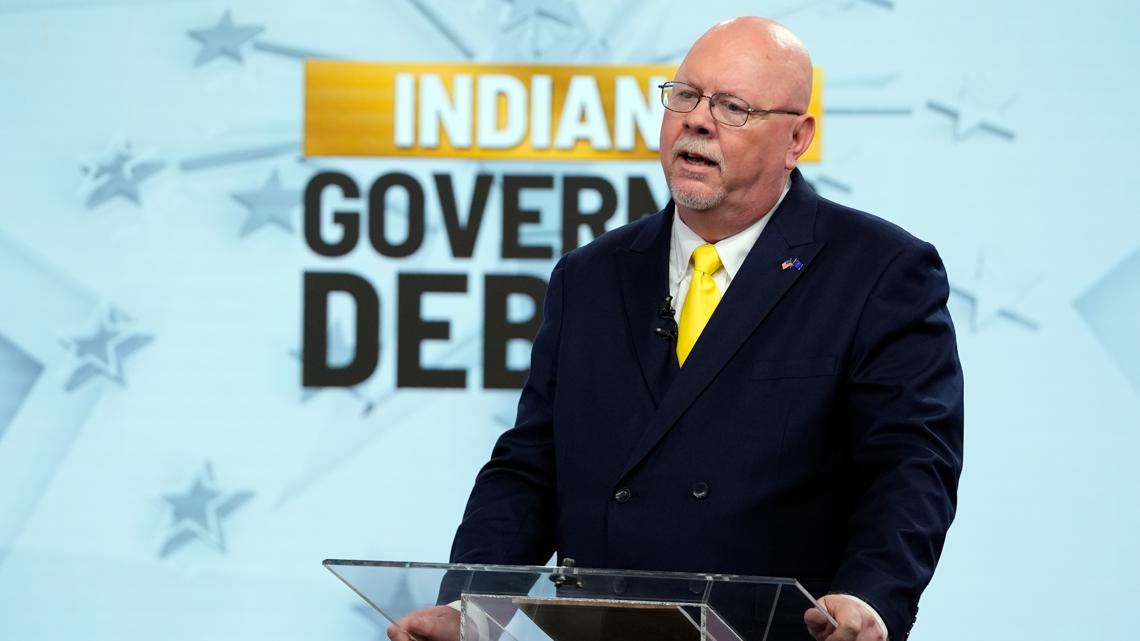

"I think the first thing that we need to do is we need to recognize that property taxes, as they're collected in Indiana today, are arbitrary," Libertarian candidate Donald Rainwater said. "We have these assessments where we've got 92 assessors, one in each county. And I could take 92 assessors to your property, and you would get 92 different assessments. It's arbitrary. It's based on someone's opinion, and then you're taxed on that."

Rainwater says Hoosiers should be taxed on "something concrete."

"My proposal has been 1% of the purchase price of the property. And then, the other piece of this is property taxes should not be collected in perpetuity. If I never own my property because the government always has their heavy hand of the threat that if I fall behind on property taxes, they can take it away from me – then I don't truly own the property. Therefore, I've said that based on the concept of a 7% sales tax in Indiana, we limit property taxes to 1% of the purchase price for seven years, and then you're done."