While the $1.9 trillion COVID-19 stimulus bill didn't wipe out student debt, it did make future student loan forgiveness tax-free for the next several years. Now advocates and some lawmakers hope the provision could clear the way for President Biden to cancel outstanding student loan debt.

Senate Democrats, led by Sen. Elizabeth Warren (D-MA) and Sen. Bob Menendez (D-NJ), included the provision in the bill, allowing there to be no taxes on forgiven student loans through 2025.

"This is a huge victory for the millions of Americans burdened by student loan debt––NO SURPRISE TAX BILLS on forgiven college loans," Menendez tweeted after his amendment with Warren passed the Senate in early March.

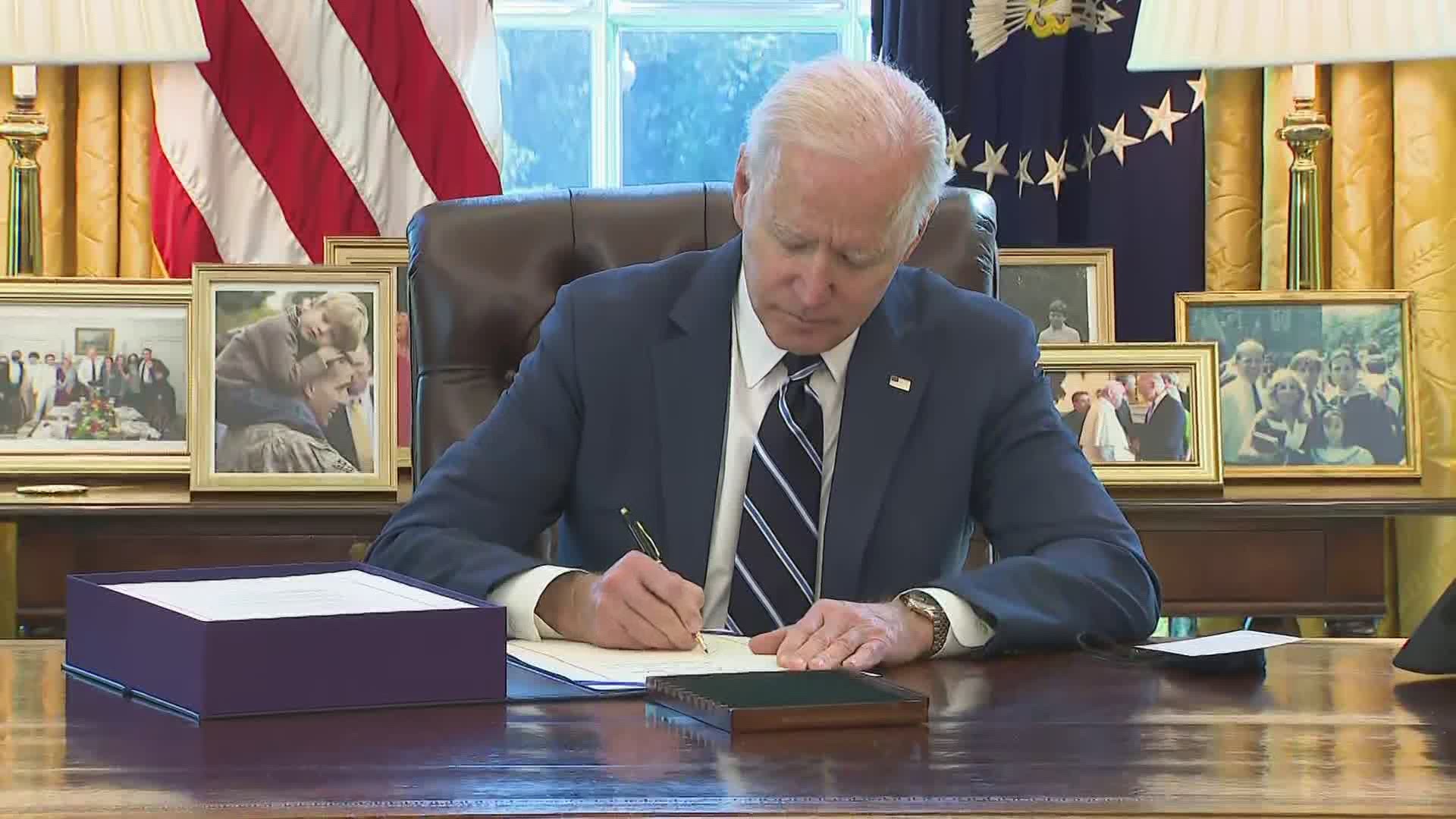

When student loans are forgiven, typically through a income-driven repayment plan, it is usually treated as taxable income. Now that the COVID-19 relief bill has been signed into law, some are hopeful that Biden will expand the pool of people with forgiven debt. According to some estimates, 45 million borrowers hold $1.7 trillion of student debt in America.

Biden has previously voiced his support for Congress eliminating $10,000 in student loan debt for individuals. However, when asked at a CNN Town Hall in February if he would increase that proposal to $50,000, he said he would "not make that happen."

Sen. Chuck Schumer (D-NY) and Rep. Ayanna Pressley (D-MA) have a total of 62 cosponsors supporting a resolution calling on Biden to cancel $50,000 in student loan debt using existing authority under the Higher Education Act. Biden stated he does not think he has the authority to do it via executive order. Schumer and Warren have publicly disagreed with that assessment.