INDIANAPOLIS — Victims of severe storms and tornadoes the moved through Indiana on March 31 and April 1, 2023, have been given a deadline of July 31, 2023, to file individual and business tax returns and make tax payments, the Internal Revenue Service announced Monday.

Following the disaster declaration issued by the Federal Emergency Management Agency (FEMA), individuals and households affected by severe storms, straight-line winds and tornadoes who live or own a business in Allen, Benton, Clinton, Grant, Howard, Johnson, Lake, Monroe, Morgan, Owen, Sullivan and White counties qualify for tax relief.

The IRS can postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area.

This includes 2022 individual income tax returns that were due on April 18, as well as various 2022 business returns normally due on April 18. Taxpayers impacted by the storms will also have until July 31 to make 2022 contributions to their IRAs and health savings accounts as part of their 2022 returns.

The July 31 deadline also applies to payments normally due during this period, including quarterly estimated tax payments and quarterly payroll and excise tax returns.

If a taxpayer hit by a storm on March 31 or April 1 in one of the counties listed above receives a late filing or late payment penalty notice from the IRS, they should call the telephone number on the notice to have the IRS abate the penalty.

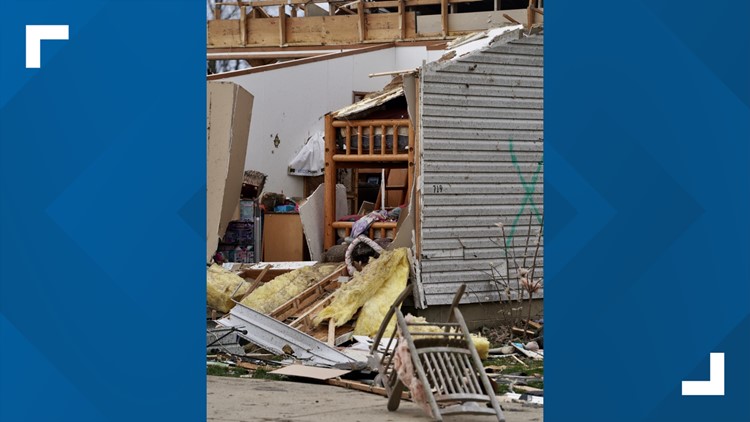

Central Indiana storm damage | April 1, 2023

The IRS automatically identifies taxpayers located in the covered disaster area and applies filing and payment relief. But affected taxpayers who reside or have a business located outside the covered disaster area should call the IRS disaster hotline at 866-562-5227 to request this tax relief.

Affected taxpayers who are contacted by the IRS on a collection or examination matter should explain how the disaster impacts them so that the IRS can provide appropriate consideration to their case. Taxpayers may download forms and publications from the official IRS website, IRS.gov.

Distance Unemployment Assistance

In addition, Indiana residents who couldn’t work as a direct result of the severe weather and tornadoes March 31 and April 1 may be eligible for Disaster Unemployment Assistance.

To be eligible for DUA benefits, individuals must meet the following criteria:

- Became unemployed, including self-employed individuals, as a direct result of the presidentially-declared disaster

- Be a U.S. citizen

- Not qualify for regular unemployment insurance benefits from any state

- Have worked or were self-employed in, or were scheduled to begin work or self-employment in, one of the counties affected by the storms

- Establish that the work or self-employment they can no longer perform was their primary source of income.

Applications for DUA must be filed by May 22, 2023.

Click here for more information about the DUA eligibility criteria.