INDIANAPOLIS — Property tax rates were a huge campaign issue during the race for Indiana governor.

Even though the election is over, the discussion on property tax increases is still getting a lot of oxygen.

That’s because for many Hoosiers, their property tax bills have nearly doubled in the past few years.

This week, Republican House Speaker Todd Huston said lawmakers would address significant property tax relief for Hoosiers in the upcoming legislative session. However, what that relief will look like is still the question.

The State and Local Tax Review Task Force, made up of Indiana lawmakers from both sides of the aisle, this week released a report following a two-year review of state and local tax systems.

If Hoosiers thought the report would give them some idea of the direction lawmakers wanted to head to reduce property taxes, they would be wrong.

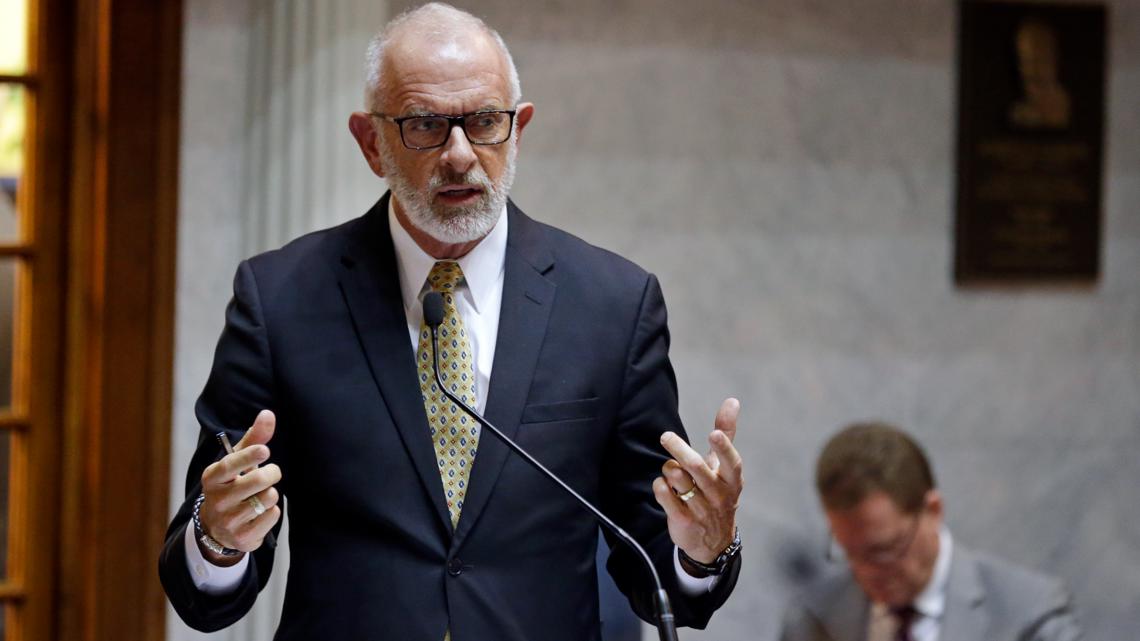

Co-chair of the task force, Republican Sen. Travis Holdman, called the report’s recommendations on property taxes, “broad,” saying any changes to the property tax system would be addressed through proposed legislation in the upcoming session.

Across the state, with home values soaring, property taxes have gone up an average of 18%. The money collected helps pay for local services like schools, libraries, police and fire departments.

The state doesn’t make any money from property taxes; it only controls and structures how the tax system works.

According to Holdman, Hoosiers should not expect to see any changes to their 2025 property tax bills, which he said are being calculated right now at the local level.

Indiana homeowners will receive those bills next spring, even before the legislative session is over.

“The die is cast,” Sen. Holdman said.

The task force report’s language isn’t specific when it comes to property taxes, only saying: “Enact more effective control on property tax bills,” and “All eligible over 65 property taxpayers should receive a credit to ensure a reduction on their property tax bill.”

The report also recommends a more “transparent and accountable property tax system” so Hoosiers can see on their tax bill when their local units reduce a tax rate.

Holdman said the task force didn’t want to get too far in the weeds addressing changes to property taxes in the report.

“They’re going to tinker on how clear your tax bills are," said Democratic Rep. Ed DeLaney, who also sat on the task force. "You can make them as clear as you want, if the numbers are the same, that doesn’t make much difference to the average homeowner."

DeLaney said the report from the task force should have included more specific recommendations on how to relieve the property tax burden for homeowners.

“We kick the can down the road, but the homeowner ends up with the can on their front porch. That’s the problem,” DeLaney said.

The Democratic representative who represents the state’s 86th District also said he doesn’t support Governor-elect Braun’s campaign proposal to bring property tax rates back to what they were in 2021, a cornerstone of the governor-elect’s campaign.

Property tax relief was at the top of a list of priorities Braun sent in a letter to lawmakers this week.

“Rolling taxes back to what they were years ago, means that all the impact of inflation, which is real, falls on the school districts. They’ll just have less money,” DeLaney said.

In 2022, lawmakers passed a series of cuts to the state’s income tax. Those cuts roll out over the next five years, with the state income tax rate set to be 2.9% in 2027.

“The cuts in the state income tax we want are much smaller than the increase in property taxes. So, thank you for giving me a 5% discount but I had 25% price increase,” Rep. DeLaney said.

DeLaney also criticized tax cuts given to corporations.

“They keep cutting the property taxes that are not for homeowners,” DeLaney said.

“So, if you own apartment buildings, you own a farm, you own a tractor, they keep giving them breaks on their taxes. You can’t do that. You can’t do that and help the homeowners, too,” he added.

According to Sen. Holdman, the corporate tax rate in Indiana is 4.9%.

“Corporations provide jobs so people can pay their taxes,” Holdman said.

“We are trying to be fair to the individual taxpayer and the corporate taxpayer,” he added.

“We are trying to find the balance of what’s fair for all taxpayers,” Holdman explained.

Say the way to reduce property taxes is to reduce spending at the local level, or cut property taxes. That would mean less property tax money for local services. One way local units could make up for that lost revenue would be to raise local income taxes.

According to Holdman, local units can impose a 2.5% income tax and add another 1.25% on top of that to increase revenue.

Even that, though, Holdman said, takes time.

“If we expect local units to be more efficient and think out of the box then, we have to hold ourselves to the same standard,” Holdman said.

“We have to control spending,” he added.

Sen. Holdman said some changes to property taxes could come by 2026, but it would take multiple years to implement larger reforms.