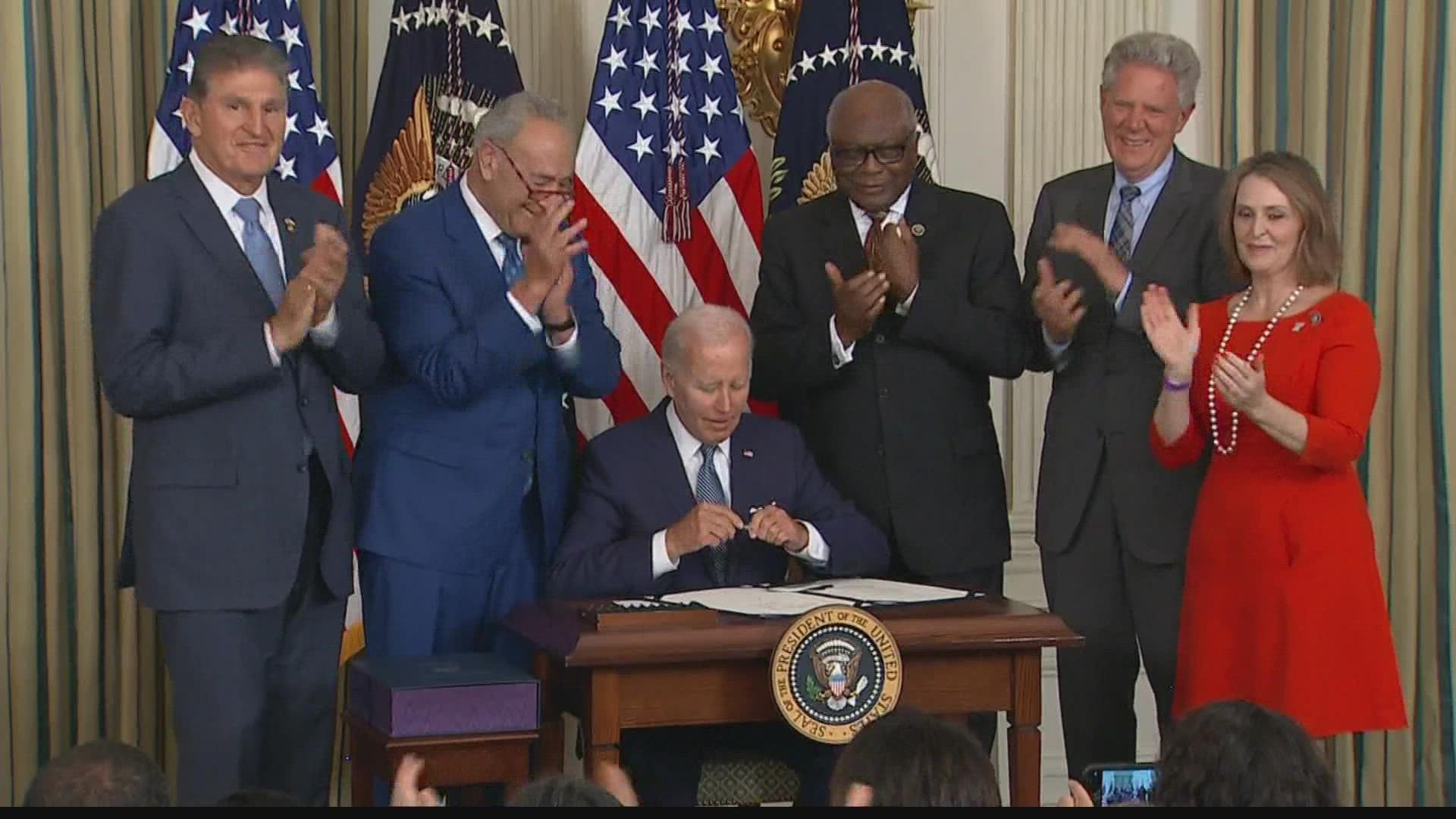

INDIANAPOLIS — President Joe Biden signed the Inflation Reduction Act into law Tuesday, a $750 billion health care, climate change and tax bill.

The new law is set to save money for millions of Americans who use Medicare for prescriptions. It also makes a historic investment in curbing global warming while reducing the national deficit.

“So there’s two pieces that it really addresses," said Kyle Anderson, an economist at IU's Kelley School of Business. "One is health care, and the other is clean energy. So it spends a lot of money on clean energy developments, providing incentives mostly in the private sector to develop new technologies and really try and drive down some carbon emissions."

For Indiana families enrolled in Medicare, paying for prescriptions is about to get cheaper.

"It limits the amount that Medicare recipients will have to pay out of pocket for a lot of different drugs and so that’s probably the area that will have the biggest impact on families. But Medicare negotiating lower prices for drugs will really be beneficial for anyone that pays into the system and for long-term financial health," Anderson said.

This act will also mark the largest investment ever in climate change in the U.S. Anderson said that investment could help Hoosier businesses.

"A lot of it has to do with manufacturing and engaging with more environmentally friendly manufacturing processes," Anderson said. "And Indiana is absolutely a leader in manufacturing, so it may not be as visible as windmills, but Indiana will definitely benefit from these initiatives."

So how is it being paid for?

A big piece of it will come from taxes, setting a 15% minimum tax on large corporations and a one-percent stock buyback tax, as well as expanding the IRS to allow more tax enforcement. Anderson said the majority of Hoosiers won't see any changes in their wallets from these taxes but said it will help to reduce the nation's deficit.

"It does in fact lead to a reduction in the deficit over a 10-year period, and that's really important because it's being characterized as a lot of spending but in fact, the act raises more revenue than it will spend by quite a bit," Anderson said.