INDIANAPOLIS — You have about two weeks to appeal your property tax bill, and amid a booming housing market, those bills have gone up.

Over the past year, the average property tax bill went up by 8% in Marion County.

After certifying numbers last week, the Marion County Assessor expects next year's bill to be 10% more than that.

Homeowners can get some help making these bills manageable.

If you register your home as your primary residence, you'll pay the lower homestead rate. And if you're over 65 years old, you can get a senior discount on homes worth less than $200,000.

But rising home prices mean many seniors may be priced out of that. Next year, the average home in Marion County will be worth about $165,000. The county assessor said lawmakers should consider doing something about that.

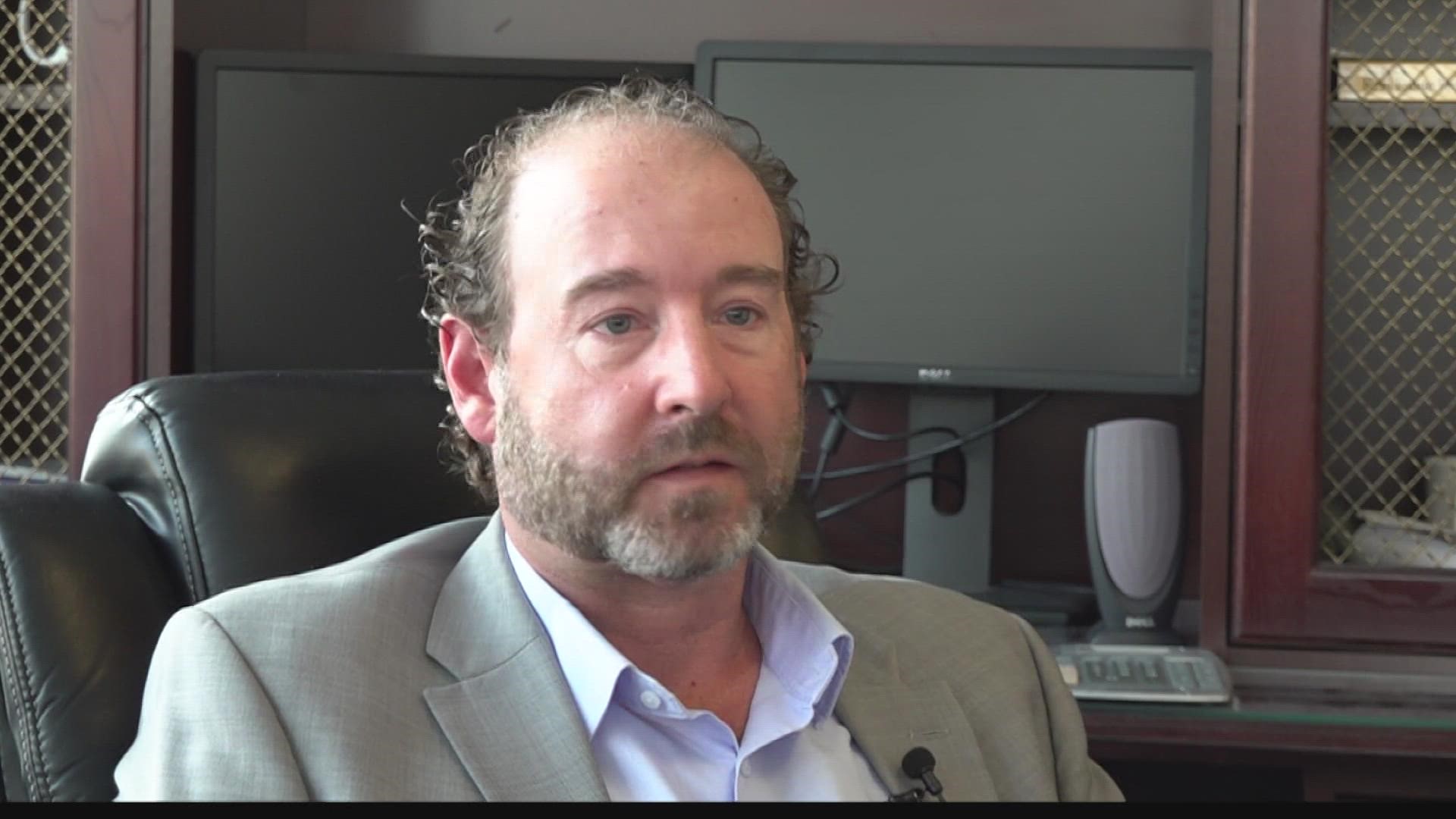

"So, I think that's something the legislature could fix and expand that to a broader universe of people over 65, and obviously I would champion that," said Joseph O'Connor.

In the meantime, if you believe your property tax bill is too high, you can appeal your assessment, but you have to do it by June 15.

According to the county's website, the appeal can be filed online, at any assessor's office location, or by mail to:

Marion County Assessor

Appeals Department

200 E. Washington Street, Suite 1360

Indianapolis, IN 46204-3319

If you choose the mail option, you're required to submit two copies of your appeal, along with a self-addressed stamped envelope.

What other people are reading: