INDIANAPOLIS (WTHR) - You may chalk it up to "if it seems too good to be true, it probably is," but it is still a crime.

We are talking about fake check scams.

It is hard to believe, but a half-million people nationwide fall victim to fraud every year. According to the Better Business Bureau, banks lost an estimated $789 million to fake checks in 2016.

"We found the largest group of victims are in their twenties," Tim Maniscalo with the Better Business Bureau said.

"That was a lot of money I lost. $1,650 that I will never see again," Edwood Bigot said.

Bigot never imagined he would become a victim. The scam works like this: you apply for a work from home job and a check arrives for expenses. After the victim deposits the check, the check clears and the victim sends a portion of the check back. But the check bounces and the victim is forced to pay restitution.

"If you are ever seeking an item or applying for a job, anything like that and you get a check for more than you were expecting and some obligation to send it back to where it was sent to you, that is almost always a fraud scheme every single time," Andy Shank with Elements Financial explained.

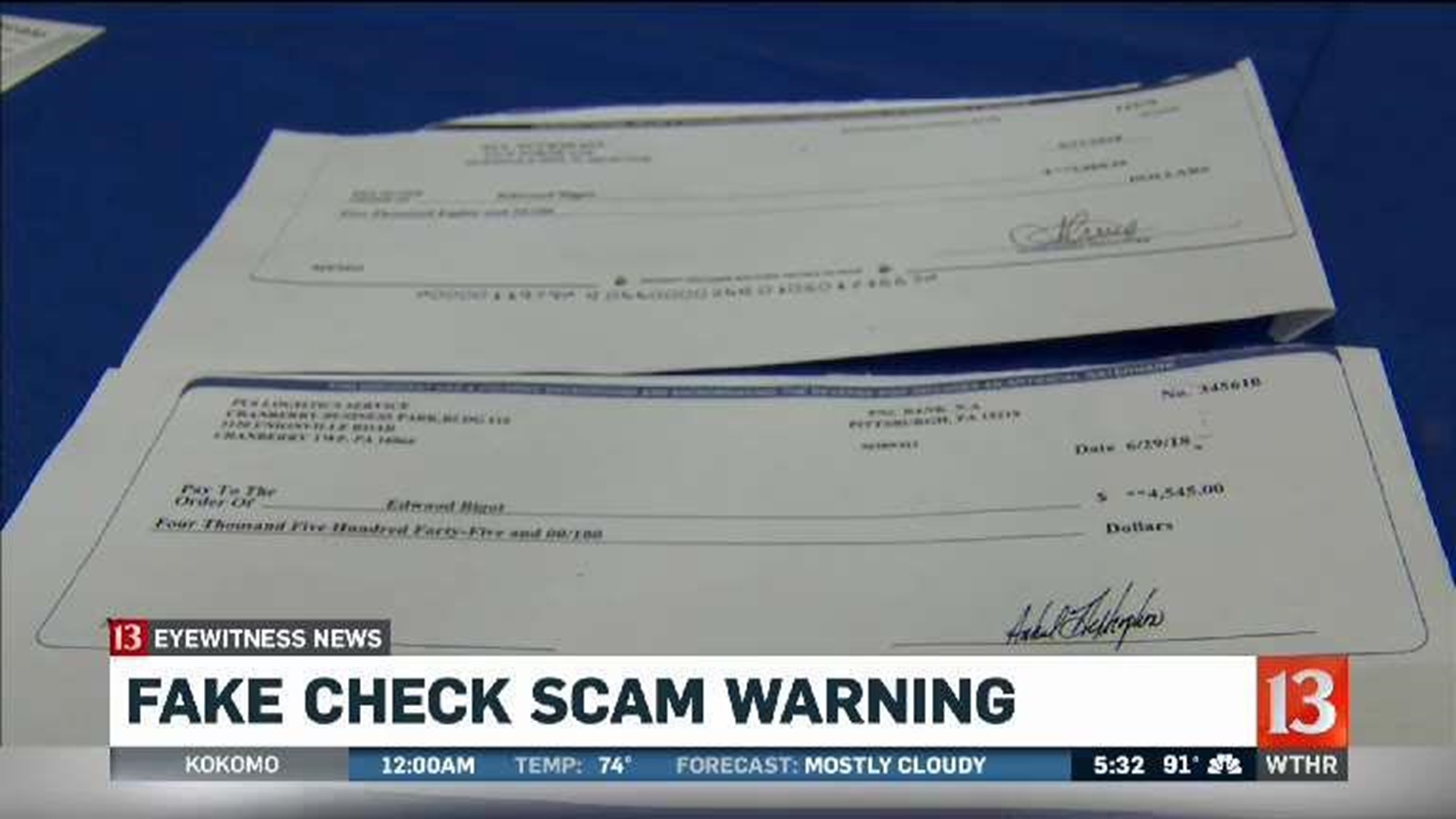

The checks that Bigot received certainly look real enough, but when the bank told him he had to pay that money back, it became all too real. Now, like most of us, he feels embarrassed.

"I wasn't going to fall for it. What the bank people told me, the check was cleared, then a couple of days later after it cleared, they told me the check had bounced. That is when I found out I had been scammed," he said.

Eyewitness News asked Edwood what advice he would give to anyone who receives such a check and he said to always call and check its validation.