If you need help preparing your taxes, the time to call a pro is now.

Millions of Americans file their taxes on their own and many of them do it online. But there are plenty of people who just don't trust themselves.

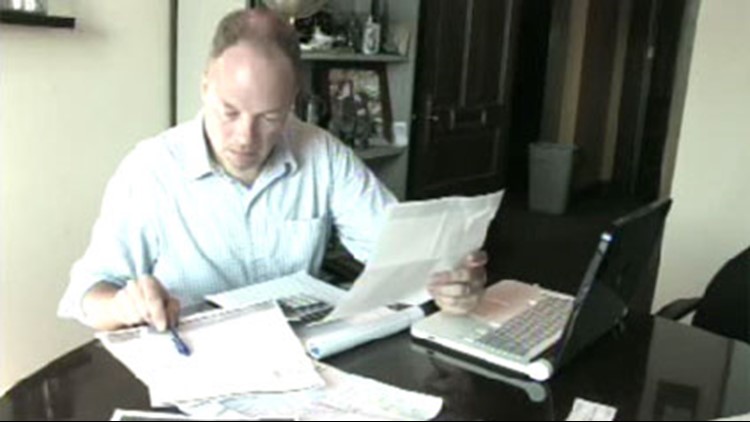

"Having a CPA do my taxes has saved me hours and probably thousands of dollars in taxes," said Mike McManus.

"People miss deductions that they are eligible for all the time. Never miss a deduction because you are afraid to take it," said Jennifer Harris, CPA.

It's probably fine for most people with simple tax situations to prepare their own returns, but small business owners, like McManus, and those with more complex situations should find a CPA they trust.

"You want to have someone you are going to have an ongoing relationship with. Also, be sure to ask and understand if they can represent you in case of an IRS audit, because not all professionals can," said Angie Hicks, Angie's List.

There is a wide range of tax preparers with varying fees, so know up front what you are paying for. Most charge an hourly rate. Be cautious about a tax preparer that can claim to get you a larger refund.

A certified public accountant is a safe bet, as CPAs are required to have 120 hours of education every three years to keep their license and are also listed on the State of Indiana website. Know their background and do your homework before you talk taxes.

"You need to make sure you have the right documentation before you take a deduction. Never estimate or guess based on last year or prior-year numbers. Specifically for 2012, make sure that if you are issued a 1099 or receiving a 1099, you do it correctly. The IRS is really cracking down on 1099 miscellaneous income and you never know when you'll be selected for an audit," Harris said.

The tax filing deadline is Monday, April 15, but it's never too early to start putting it all together.