What Hoosiers need to know about surprise medical bills — and how to prevent them

In 2017, one patient out of every six visiting the emergency room or staying inpatient at a hospital came home with at least one out-of-network medical bill.

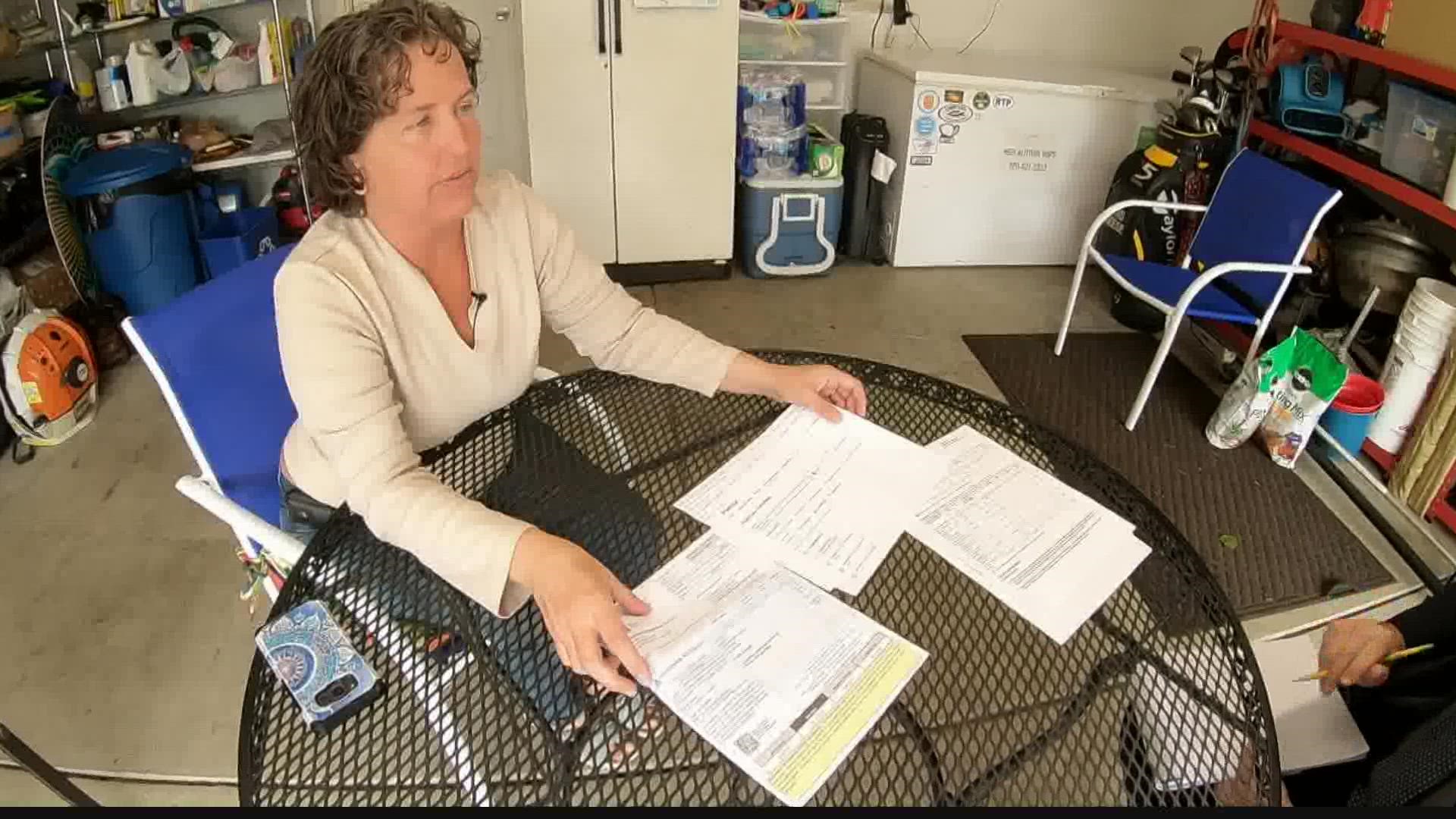

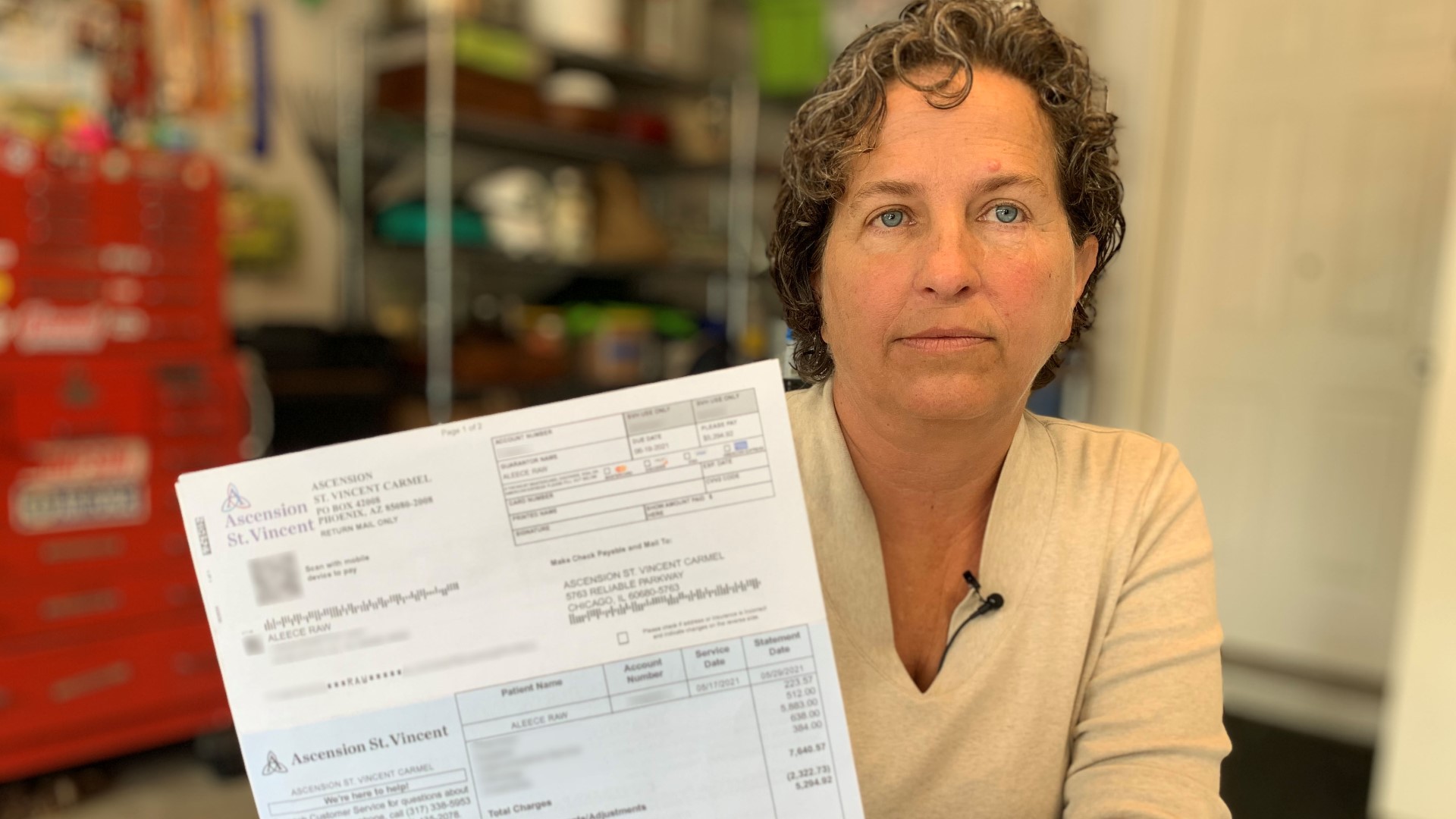

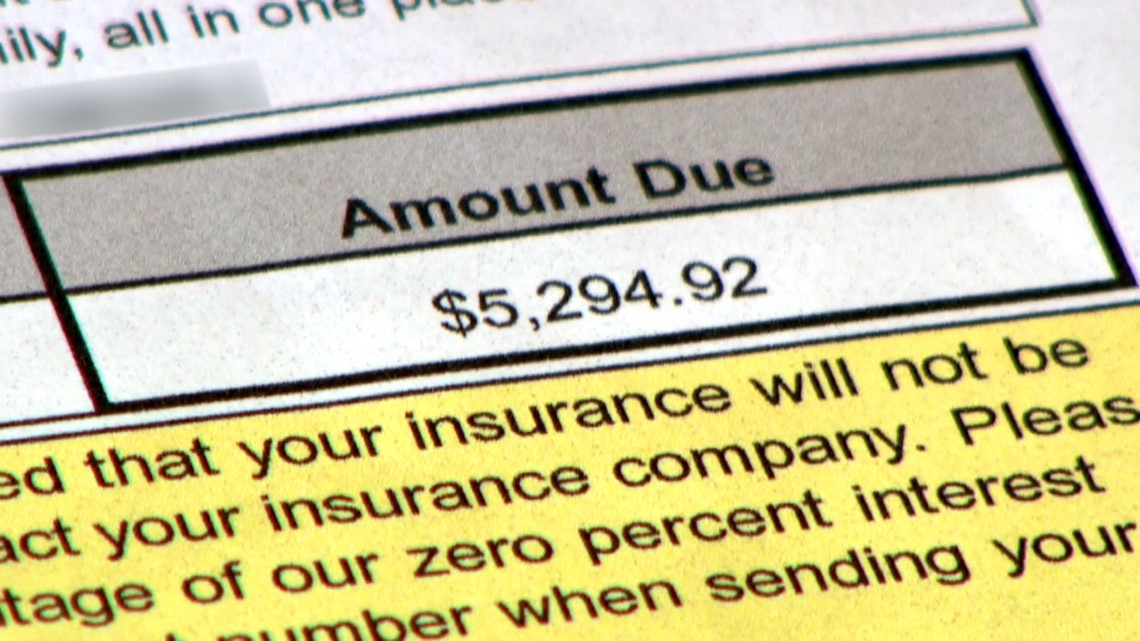

Aleece Raw remembers the moment she opened the bill. Her heart sank.

“I kept staring at it, and I just couldn’t believe it because it didn’t make sense,” she recalls. “I almost had a heart attack.”

The $5,294.92 invoice arrived about a month after Raw had a routine colonoscopy at a hospital in Carmel. She had good reason to believe the procedure would be fully covered by her insurance.

“I contacted my insurance company before the procedure specifically to make sure that colonoscopies were covered, and they said they were,” Raw told 13News. “In-network screenings are covered at 100%, and so that’s when I looked up the doctor, saw the doctor on their website and said, ‘Yeah, I’m good.’”

Raw also asked the hospital if its facility was considered in-network by her insurance plan. An e-mail confirmed it was.

In-network hospital. In-network doctor. Routine procedure. It all seemed simple — until the bill arrived.

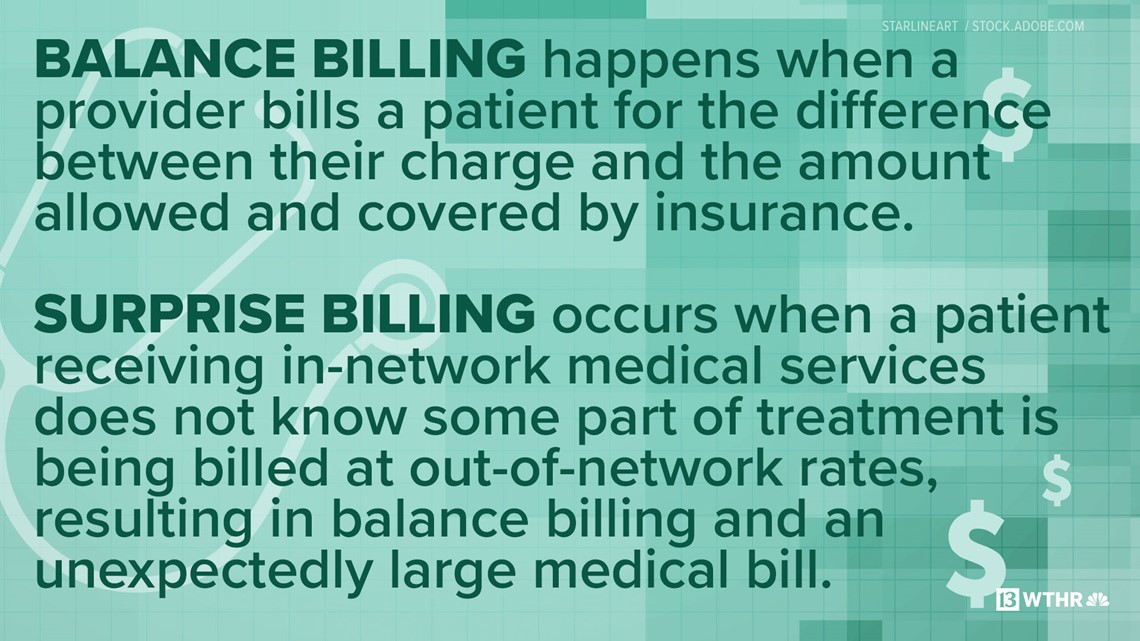

Months later, Raw says neither the hospital nor her insurance carrier have been able to explain why she got a medical bill for more than $5,000. An explanation of benefits from the insurer suggests some of the services rendered during her colonoscopy at the in-network hospital were billed at out-of-network rates – a widespread practice known as “balance billing” that results in patients bearing responsibility for unexpectedly large medical bills.

That type of surprise billing impacts millions of Americans and costs billions of dollars annually, but it isn’t supposed to be happening.

Nearly two years after state lawmakers passed legislation to curb surprise medical bills in Indiana, 13 Investigates has found the problem continues — much to the dismay of patients, state leaders and hospitals.

“Caught in the middle”

Surprise medical billing happens every day. The problem is nationwide, and it’s been growing.

A recent study by the the Peterson Center on Healthcare and Kaiser Family Foundation found in one of every six emergency room visits and inpatient hospital stays in 2017, patients came home with at least one out-of-network medical bill.

Another study by researchers at Stanford University suggest the numbers might be much higher. That research examined hospital admissions involving more than 19 million patients between 2010 and 2016, and found 42% of visits to in-network hospitals in 2016 (for both emergency and in-patient scheduled services) resulted in at least one out-of-network charge — a dramatic increase from just several years earlier.

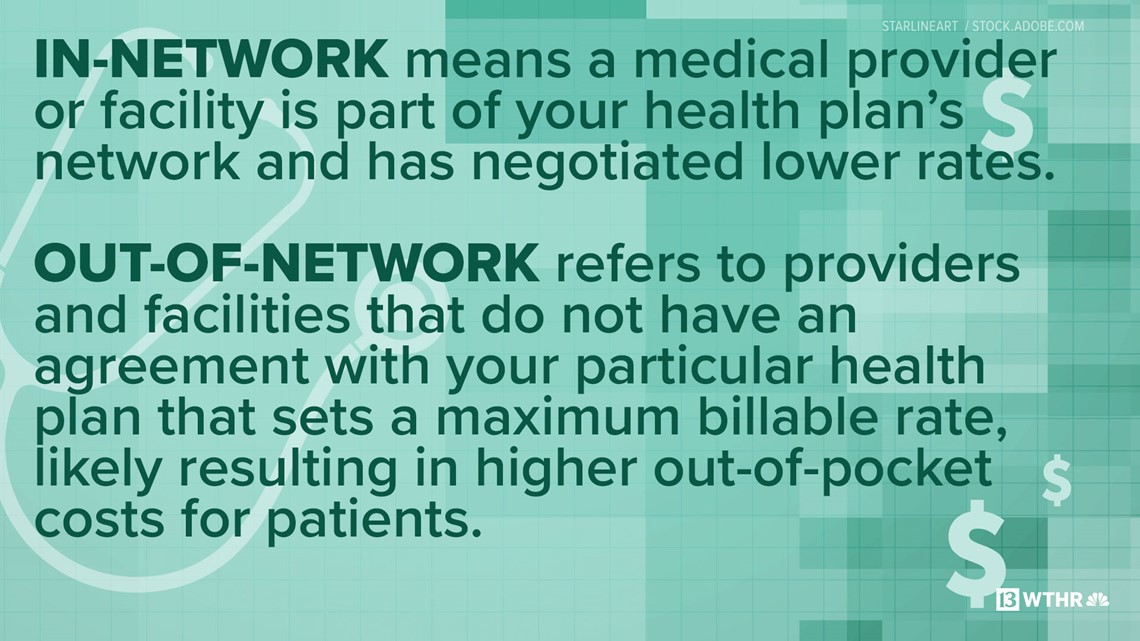

Most insured patients who need a medical procedure at a hospital or clinic choose a facility that is considered in-network, meaning it is included in their insurance company’s preferred network of medical facilities whose negotiated rates are lower than medical facilities outside the network. As a result, patients who receive services at in-network facilities are usually charged less, and their medical procedures are often covered 100% by their insurance companies (minus any plan deductibles).

But doctors who perform medical services at those in-network facilities are not necessarily considered in-network, as well. Many physicians work independently or for a private group of doctors who contract their services to local hospitals, and they negotiate their own rates with insurance companies. Doctors who do not agree to accept lower reimbursement rates offered by insurance companies are penalized by not being allowed “in network” where their services will be less expensive and, therefore, more attractive to members of that insurance plan.

In a truly transparent marketplace, consumers could choose whether to select an in-network or out-of-network doctor, knowing the expenses that would come with each choice.

But the medical marketplace is far from transparent.

Even if you do choose an in-network surgeon to perform your medical procedure at an in-network hospital, the anesthesiologist in the operating room or the radiologist who reads your scans and X-rays might be private, out-of-network specialists who do not fall under the insurance carrier’s discounted in-network rates. And some of the medical equipment or supplies used during the operation might not be covered under your insurance company’s in-network plan either.

As a result, the final bill you get from a hospital might be much higher than expected as unsuspecting patients are charged the difference — or balance — between the negotiated, allowable in-network rates and the higher rates charged by an out-of-network provider.

“This can happen at a hospital. It can happen at a surgery center. It can even happen in a physician’s office,” said Brian Tabor, president of the Indiana Hospital Association. “Patients should not be in the middle of these billing disputes and, unfortunately, sometimes that’s what happens.”

Aleece Raw says she was caught in the middle with thousands of dollars at stake.

“In my mind, it’s so flagrantly dishonest,” she told 13News. “To not even have a conversation with me ahead of time to let me know that a doctor or some part of the procedure was out-of-network, that’s just not right.”

Indiana’s solution on hold

Many lawmakers now side with angry consumers and want surprise medical bills caused by balance billing to be banned.

Early last year, the Indiana General Assembly overwhelmingly approved a new law designed to drastically reduce surprise medical bills for unsuspecting patients like Raw.

“That is exactly the type of person we are trying to help,” said Indiana State Rep. Ben Smaltz (R-Auburn).

Smaltz authored House Bill 1004, which requires doctors and health care facilities to be much more transparent about what their services will cost.

“Your healthcare is so important, it’s only fair that a person knows what they’re going to pay,” Smaltz told 13News. “What other business do we do in our everyday lives that we get the service done, have no idea what it’s going to cost, and in the end are expected to pay whatever we’re told? You wouldn’t buy a car that way.”

Indiana’s new balance billing law implements the following changes:

- Post prices online: Hospitals, outpatient surgical centers and urgent care centers must post on their websites pricing for their most common medical procedures

- Good faith estimates: For non-emergency medical services, practitioners must provide a non-binding good faith estimate of charges within five business days to any patient who requests one before the services are performed

- Notification of rights: Practitioners and facilities that provide non-emergency medical services must take multiple steps to notify patients that they are entitled to receive a good faith estimate upon request

- Limit the amount of surprise bills: Out-of-network practitioners who provide services to a patient at an in-network facility cannot collect more than the patient’s in-network allowable rate unless they: 1) notify the patient at least 5 days before services are performed that they are out of the patient’s insurance network and intend to charge a higher rate, 2) provide a good faith estimate of charges, and 3) receive written consent from the patient authorizing the practitioner to charge the higher out-of-network rate

- Explain estimate errors: If charges from a practitioner or facility exceed a good faith estimate by $100 or 5% (whichever is greater), the practitioner or facility must explain the excess charges to the patient in writing

- Penalty for non-compliance: Practitioners and health care facilities that fail to provide good faith estimates or to notify their patients of their rights to obtain them can be fined up to $1000 per violation

The state law does have some significant limitations and loopholes.

For example, it applies only to individuals who are insured by state-regulated health plans. Most Hoosiers are enrolled in group health plans that fall under federal compliance laws and are not regulated by the state. And the state law applies only to scheduled medical procedures, which means patients who need health care provided in emergency rooms and in other urgent care situations do not qualify for the same surprise billing protections.

Governor Eric Holcomb signed HB 1004 into law in spring 2020, and it was supposed to take affect a year later to give hospitals, physicians and insurance companies time to prepare for the changes.

While some elements of law did kick in on July 1, 2021, implementation of the most important aspect of Indiana’s new balance billing law – the restriction that limits how much out-of-network providers can charge you when you get services at an in-network facility – has been delayed until next year. State lawmakers pushed back the start date to coincide with federal legislation that takes effect in January.

If the law had implemented earlier, Aleece Raw could have learned before her medical procedure that some required services would be billed as out-of-network. Raw says she would have made a choice to go somewhere else.

“Absolutely. There’s no way I would have paid this kind of money for a procedure I could have gotten in-network and covered 100%,” she said.

Who’s to blame?

Balance billing is a complex issue, and determining who bears responsibility for surprise medical bills is complicated, as well.

Hospitals agree surprise bills are a big problem, but they insist hospitals are rarely the cause.

“I think this is giving the [hospital] industry a black eye. It has. But surprise bills rarely involve the hospital itself,” explained the president of the Indiana Hospital Association.

Tabor says most of the surprises arise out of disputes between insurance companies and private doctors who work at hospitals. But because hospitals often mail the bills for all of the services rendered during a hospital stay or procedure, they get pulled into the dispute -- with patients getting stuck in the middle.

“Surprise billing laws take patients out of the middle, and as hospitals, that’s what we want to see,” he said. “We need to end this.”

The Indiana State Medical Association, which represents the interests of thousands of Indiana physicians, says it also wants to remove consumers from being caught in balance billing disputes.

“ISMA looks forward to working with lawmakers next year on improvements that will address the confusion over the state law and better protect patients from getting ‘stuck in the middle’ between their health care provider and their insurer. We always recommend patients reach out to their health care provider with any questions they have about their medical bills,” ISMA executive vice president Julie Reed wrote in a statement to 13News.

She believes the solution to this widespread billing problem requires partnership.

“Given the complexity of health care billing, all the players in the health care community – physicians, health systems and insurers – need to work together on a solution that best serves patients and protects them from surprise medical bills,” Reed added.

Federal law offers hope

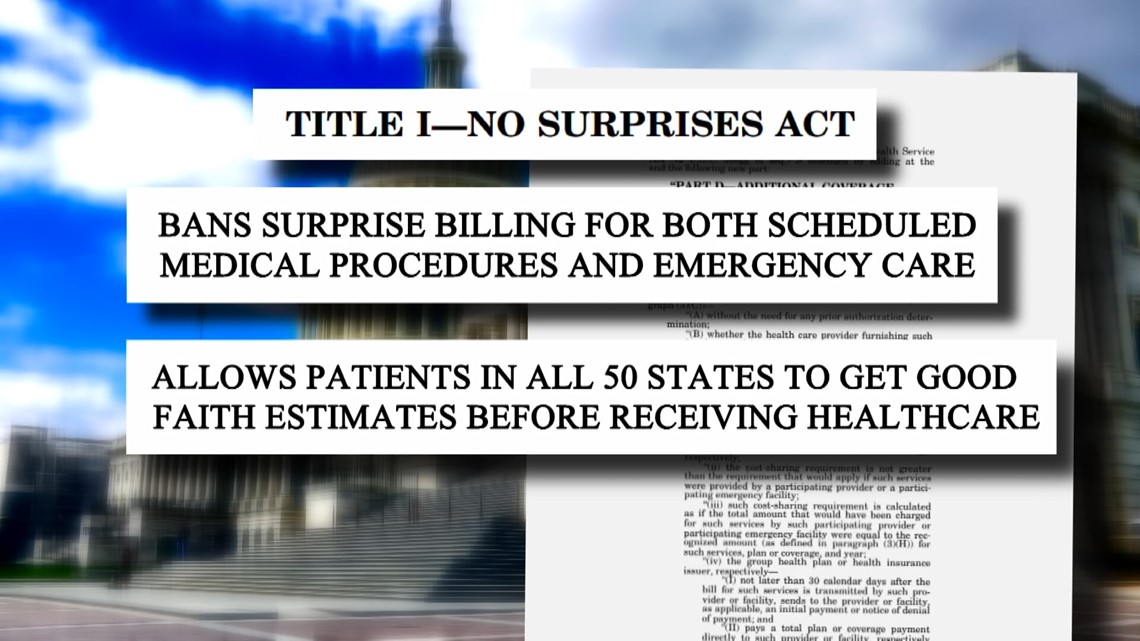

To remove consumers from the billing tug-of-war between medical facilities, doctors and insurance companies, Congress passed the bipartisan No Surprises Act in 2020. The federal law will essentially ban surprise billing for both scheduled medical procedures and emergency care, and it will allow patients in all 50 states to get good faith estimates before receiving their healthcare.

The No Surprises Act, which begins on page 1577 of the massive Consolidated Appropriations Act of 201, will take effect January 1, 2022, and offers patients more comprehensive protections than Indiana’s state law. The No Surprises Act will:

- Prohibit health care providers from billing patients for more than the in-network cost-sharing included in patients’ insurance plans for nearly all health care services, including both elective and emergency care as well as transport by an air ambulance (ground ambulance transport is an exception)

- Require health plans to consider out-of-network services as in-network when calculating patients’ share of costs

- Establish an arbitration process to settle disputes between out-of-network providers and insurance companies

- Require out-of-network providers to notify a patient of their out-of-network status at least 72 hours before they provide their service and to get written consent from the patient to receive the out-of-network service

- Require health care providers and facilities to provide a good faith estimate of charges to any patient who is uninured or who plans to self-pay for a medical procedure out-of-pocket

- Create a dispute resolution process to determine a patient payment amount when an uninsured or self-pay patient receives a bill that substantially exceeds a good faith estimate (more than $400 higher than estimated)

According to an analysis by the Brookings Institution, a non-profit public policy organization, the federal law is expected to save consumers a lot of money.

“The Congressional Budget Office estimates that the No Surprises Act will reduce commercial insurance premiums by between 0.5% and 1%, saving taxpayers $17 billion over ten years and saving consumers about twice that much between reduced premiums and cost-sharing,” Brookings fellows wrote.

With the recent release of interim final rules for the No Surprises Act, the Indiana State Medical Association says it is assessing what changes are needed to the state’s surprise billing law. “The ISMA strongly supports protecting patients from surprise medical bills,” Reed said.

Most consumers are not aware of the new state and federal laws, but health care experts say they should be.

“Surprise billing has been something that’s been talked about for decades. I think everyone has been looking for a solution, and we now have a solution on the horizon,” said Tabor, who says the federal law will close gaps in state balance billing regulations. “I think it’s going to be an effective one.”

“I absolutely love it,” Raw told 13News, when she learned of the No Surprises Act. “I just think this billing is so complex now that we have to, as patients, demand something be put in writing beforehand with full estimates and prices.”

Raw has disputed her $5,294 bill and is still waiting for the hospital and insurance company to explain why she should pay it. Stories like hers are unlikely to go away – at least for a couple more months.

“Until January 1st, I think we’re really not going to see an end to that,” Tabor said. “After that, I hope it becomes a thing of the past.”

How to avoid getting a surprise medical bill

Despite the new laws, medical billing can still be hard to understand and not very transparent. Knowing the resources that are available and the right questions to ask can go a long way in helping to reduce your risk of getting a surprise bill.

Ask the right questions

These three questions will help you determine if you are at risk for a surprise medical bill:

- Is my doctor or medical specialist in-network? (Yes = lower health care costs)

- Will I receive services from anyone else during my procedure who is not in-network? (Yes = higher health care costs)

- Is the facility in-network? (Yes = lower health care costs)

Whenever possible, get the answers to these questions in writing.

It's important to use the term “in-network” when asking these questions. While a doctor or facility might “accept” your insurance, that does not necessarily mean they accept your specific plan.

These questions also need to be asked every time you receive health care. Many plan providers change from one year to the next, and a doctor who might be in-network this year could be out-of-network in a couple of months.

Determined to avoid a surprise medical bill, Caitlin Donovan, a health care policy expert with the National Patient Advocate Foundation, got creative when she had an in-patient hospital visit for the birth of her child.

“We thought really carefully about what we could do to try and preempt some of those extra billing charges. So we made a sign for our door that said, 'If you are not on our insurance, please do not come in,’” Donovan said.

Starting in January 2022, medical providers and facilities will be required to notify you of any out-of-network practitioners who will be providing your health care and obtain your permission before they can seek reimbursement for higher out-of-network rates.

Request a good faith estimate

In many situations, new state and federal laws will require health care providers and facilities to provide a good faith estimate to patients – as long as you request one. In some situations, those good faith estimates are required whether requested or not.

If you are legally entitled to an estimate, ask for one, and do as soon as possible. Make sure to request a good faith estimate at least five business days prior to your procedure (providers do not have to provide an estimate if given less notice) to catch potential surprises before you receive your medical care. Realizing that you may receive services from an out-of-network provider before your procedure gives you an opportunity to reschedule the medical care at a different facility that might not use out-of-network providers, costing you much less.

Use online price tools

Indiana hospitals are now legally required to provide an online list of prices for their most common procedures. Checking those price estimator tools allows patients to shop around for prices, which is especially valuable for those who are uninsured or planning to pay for health care services out of pocket.

13News used several hospitals’ price estimator tools to check the costs of common services on October 27. The out-of-pocket patient costs listed for self-pay services were dramatically different based upon the hospital selected:

30-minute new patient office visit (CPT 99203)

- Ascension St. Vincent Fishers $785

- Health Network $129

- IU Health North Hospital $59

Arm X-ray with 2 views (CPT 73060)

- Ascension St. Vincent Carmel $326

- Community Health Network $182

- IU Health University Hospital $128

Colonoscopy with biopsy (CPT 45380)

- Ascension St. Vincent Carmel $7,375

- Community Health Network $4,329

- IU Health University Hospital $3,615

Comparing costs with the hospitals’ price estimators showed significant out-of-pocket self-pay price differences even at hospitals that are part of the same health system:

Routine childbirth without complications (CPT 807)

- IU Health University Hospital $7,550

- IU Health West Hospital $4,966

- Ascension St. Vincent 86th St $20,080

- Ascension St. Vincent Anderson $12,637

The non-binding estimates often include a series of disclaimers, including warnings that estimates may not include out-of-network provider charges and various support services required during procedures. Insured patients may find it more difficult to get an accurate estimate without calling a health care facility directly to provide more detailed insurance information. Nonetheless, the price estimator tools are a positive step towards medical billing transparency.

You can usually find price estimates online by typing the name of a specific hospital network and the term “price estimator” into a search engine. (For example, Google “IU Health price estimator.”)

The Indiana Hospital Association also offers its own search tool that allows Hoosiers to find hospital-specific price information for common services, out-of-pocket costs and standard charges for items and services.

Print or screenshot this questionnaire as a guide when it's time to book an appointment or procedure.

----

A spokeswoman for Ascension St. Vincent Hospital in Carmel, the facility where Aleece Raw had her colonoscopy, did not answer questions about Raw’s bill, but she did send 13News the following statement:

"We remain committed to making health care accessible regardless of a patient's ability to pay. Insurance plans are highly individual with varying deductibles, which can result in cost fluctuations. We strive to work with patients to help them access the information they need to make informed decisions about their care. In alignment with federal regulations, we have made available a database of raw pricing for industry analysis as well as a consumer price estimator tool for hospital services at https://healthcare.ascension.org/price-transparency. Pricing does not reflect our financial assistance and charity care policy, and could vary by individual patient and by facility. We encourage those who are seeking or scheduling care to contact their care site for more information on pricing."

----

Editors note: State Rep. Ben Smaltz, who was interviewed for this report, is related to a 13News employee. That WTHR staff member did not contribute to this story.