INDIANAPOLIS — For many Hoosiers who find themselves out of work because of COVID-19, getting laid off has not been the most frustrating aspect of the pandemic.

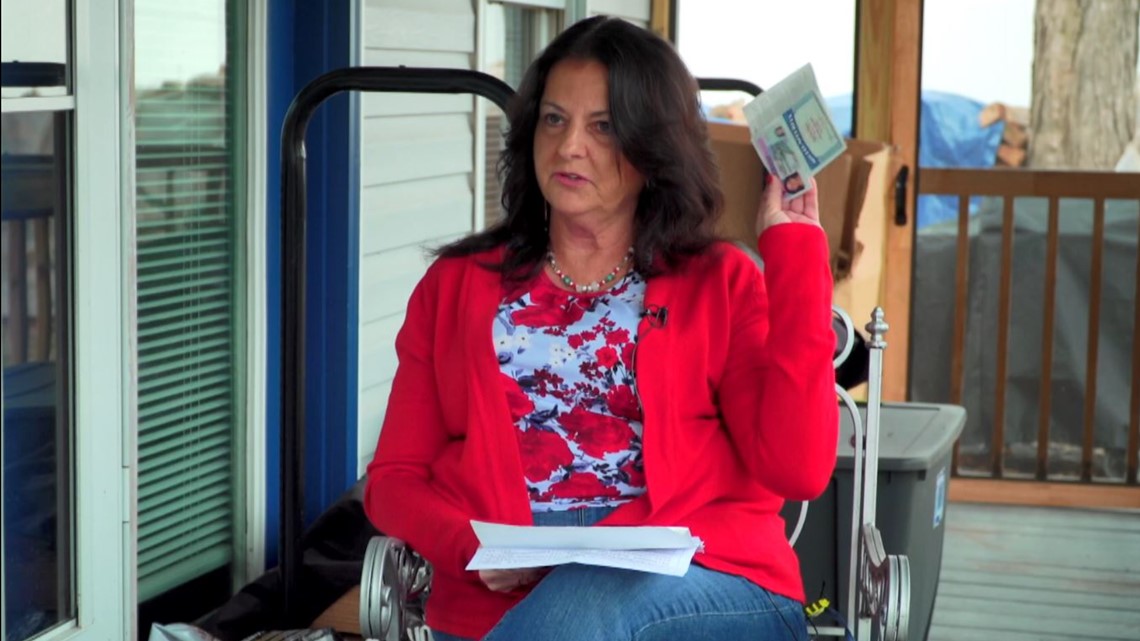

“As of September 1, we were all out of jobs,” said Erin Fisher-Leser, a compliance specialist who was laid off this fall by an Indianapolis travel management company. “There I was, filing for unemployment for the first time in a really, really long time, and when I tried to file online, I was locked out of the system.”

Yvonne Matlock tells the same story. The pandemic triggered job cuts at the healthcare facility where she worked as a fundraiser. And even though Yvonne received a severance package, former co-workers encouraged her to begin the process of establishing an account with the state unemployment office.

“My last day of employment was Nov. 6,” she told 13News. “Right away I got online to set up my account and it said I already had an account. I couldn’t even set anything up. I knew something was wrong.”

Erin and Yvonne quickly discovered why they could not set up accounts to file unemployment claims with the Indiana Department of Workforce Development: somebody had already beat them to it.

“Someone had opened an account on the 29th of June under my previous married name of over 30 years ago. They also set up bank account routing information,” Erin said.

“Someone filed a claim using my Social Security number in Philadelphia,” Yvonne explained. “I’ve never lived in Philadelphia in my life, so when I talked to someone at the unemployment office, I said ‘No, that’s not me.’”

First they lost their jobs. Then they discovered their identities were stolen. And then came the most daunting part: battling DWD to get their lives back in order.

Yvonne and Erin are victims of a widespread cyber fraud scheme that has diverted tens of billions of dollars in unemployment assistance away from the laid-off workers who need it most. It is happening all across the country. But here in Indiana, state officials are hesitant to discuss the scope of the problem, and 13 Investigates has discovered Indiana’s unemployment system often revictimizes the unemployed workers it is supposed to help.

Largest fraud attack in U.S. history

For Erin and Yvonne, the unemployment fraud scam has been devastating. Both spent hours contacting law enforcement, state and federal agencies and credit bureaus to deal with the aftermath of having their identities stolen.

At the same time, the ladies say they have also spent countless hours trying to reach call center employees and fraud investigators at DWD. Erin and Yvonne each contacted 13News after calling and emailing the state agency dozens of times with no resolution -- which means for months, they could not file unemployment claims after they lost their jobs.

“I feel like they don’t care, that they just really don’t care,” Yvonne told 13News. “When you call, you get a different person every time. It’s like you’re not even a number to them. You’re just a person on the other end of the phone,” she said, wiping tears from her eyes.

“My savings is pretty much gone, and what do you do from here?” Erin said in December, after waiting more than three months for DWD to unlock her hacked unemployment account. “Nobody’s responding. Nobody’s doing anything… and it’s frustrating, challenging, demeaning,” she added, also breaking down into tears. “I’m not the only one, and that’s what’s heart wrenching.”

Erin and Yvonne do have plenty of company.

“This is the largest cyber attack in terms of fraud in American history. Period,” said Blake Hall, a security expert who founded ID.me, a company that is now helping Indiana DWD and other state unemployment offices fend off massive amounts of fraud. “You have organized crime rings from Russia, from China, from Nigeria, from Ghana, as well as a lot of domestic identity thieves, and they’re all working together on the dark web. They’re sharing information about how each state works to defraud the state, and they just follow a playbook.”

The playbook calls for defrauding each state’s Pandemic Unemployment Assistance program, better known as PUA. Soon after COVID-19 began sweeping across the country, resulting in a rapid increase in layoffs, Congress approved the PUA program to get money to laid off workers quickly. Unlike other assistance programs, PUA is available to self-employed workers, independent contractors and those who are otherwise ineligible for regular unemployment benefits. To provide maximum flexibility, Congress allowed each state to administer its own PUA benefits.

But a program designed to send out money fast is also vulnerable to fraud. Con artists quickly discovered how to scam the federal unemployment program by using stolen Social Security numbers to submit bogus unemployment claims. Because the original PUA program allowed claimants to backdate their claims, scam artists discovered they could use a single Social Security number to collect a windfall.

“With a backdated claim to Feb. 2, you could literally turn one identity into tens of thousands of dollars. For organized crime, there is no target that’s anywhere near as lucrative as an identity that could be converted to a debit card loaded with $10,000 or $20,000,” Hall told 13News. “So these [state] agencies then became a target for every organized crime ring in the world, and they just weren’t equipped for it.”

An inspector general report released by the US Labor Department last fall estimated scammers had already stolen at least $36 billion (yes, BILLION) in fraudulent unemployment payments. The actual number is likely much higher.

“I’d estimate the loss to be over $50 billion, at least, across the country,” Hall said.

State leaders won’t say much about the problem

13 Investigates contacted DWD in early December to ask how big this problem is across Indiana. Specifically, 13News asked how many fraudulent unemployment claims the department had received, how much of the $6.48 billion in 2020 unemployment payouts went to con artists trying to scam Indiana’s PUA program, and the steps DWD takes when it determines that an unemployment claim has been filed by an individual using another person’s Social Security number.

It appears Indiana’s Department of Workforce Development either doesn’t know the answers to those questions or will not publicly release the information. Two months after receiving WTHR’s request submitted under the Indiana Access to Public Records Act, DWD has not answered any of 13News’ questions and has repeatedly refused to meet with 13 Investigates to discuss the issue.

On Jan. 7, DWD spokesman Bob Birge told 13News “I hope to have some answers for you shortly,” and when asked again a week later, Birge wrote “Will check on your APRA request.” He has not responded since. The governor’s office also declined a request for an interview.

A spokeswoman for the governor’s office provided a general statement. “DWD has fraud prevention and detection tools in place to prevent fraudulent payments from being issued. If any payments are issued, and subsequently determined to be fraudulent, DWD works with law enforcement and any banks that were involved in an effort to recover the funds,” she wrote.

By comparison, other states have been very transparent about the scope of their unemployment fraud and identity theft.

In late January, California Labor Secretary Julie Su told reporters in a conference call that the state has paid $11.4 billion in fraudulent unemployment claims during the pandemic. That represents 10 percent of the $114 billion California has paid in unemployment claims during the COVID-19 pandemic, and another 17 percent of payments is under investigation.

"There is no sugarcoating the reality," Su said. "California has not had sufficient security measures in place to prevent this level of fraud, and criminals took advantage of the situation."

This week, Ohio Department of Job and Family Services Director Kimberly Henderson revealed ODJFS paid at least $330 million in fraudulent pandemic unemployment benefits claims between April and December of 2020, and that state agency has identified at least 56,000 fake PUA claims.

And the Colorado Department of Labor and Employment says it paid out $6.5 million in fraudulent unemployment benefits in the fourth quarter of 2020. “We’re now in the fraud business, and, a year ago, we were not,” CDLE executive director Joe Barela told Denver’s 9News on Thursday. He said CDLE now scans every unemployment claim for more than 50 fraud triggers, which has helped the agency prevent almost $100 million in fraudulent payments.

While state officials in Colorado, Ohio and Colorado are willing to openly discuss their unemployment fraud numbers, state leaders in Indiana have, so far, chosen not to release that type of information.

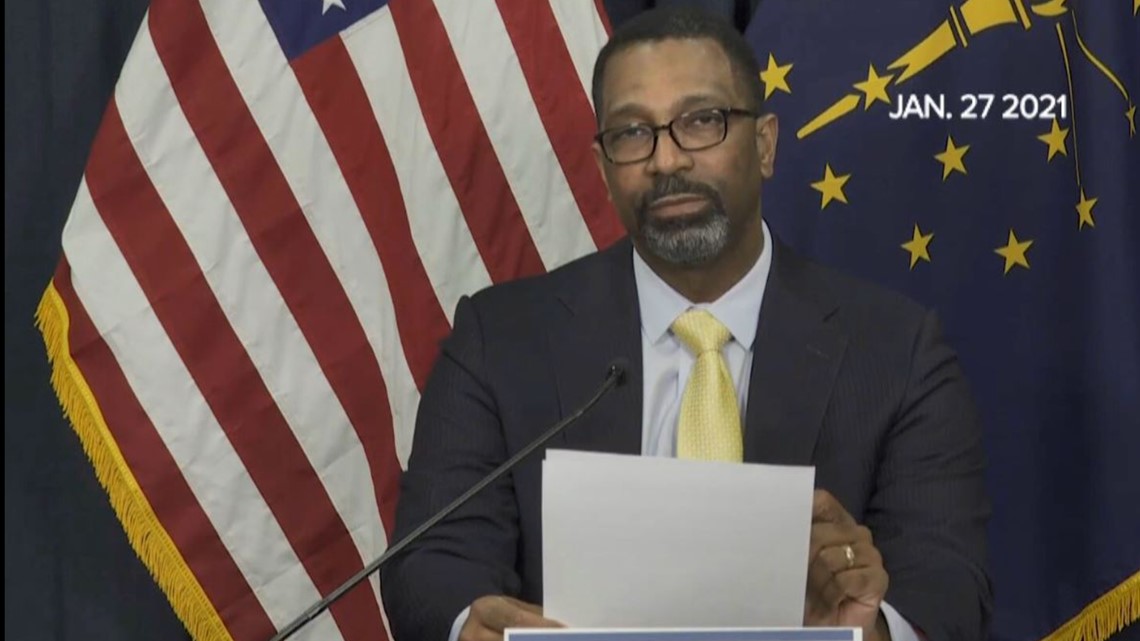

But last week, following WTHR’s repeated inquiries to both DWD and the governor’s office, DWD commissioner Fred Payne did publicly acknowledge that fraud has hit Indiana’s PUA program very hard.

“We’ve become targets of fraudsters and scammers,” Payne said while discussing the state’s unemployment program during the governor’s weekly COVID-19 virtual press conference. “Seventy-one percent of current PUA claims have fraud indicators that require additional investigation.”

The commissioner did not discuss overall numbers to shed more light on the true scope of unemployment fraud in Indiana, but 13 Investigates obtained a list of complaints from the Indiana Attorney General’s office that shows how the problem has exploded.

According to the AG’s data, the first unemployment identity theft complaints in Indiana came in late April, just a few weeks after DWD implemented the federal PUA program. In June, the AG’s office received 14 complaints of identity theft linked to unemployment claims. By December, Hoosiers were filing more than 550 complaints per month – a nearly 4,000% increase.

Behind the scenes, DWD is reeling from the fraud.

Last week, during a webinar to discuss unemployment fraud with business leaders and employers, DWD chief of staff Josh Richardson said, “We know we’re being attacked daily by people trying to obtain fraudulent benefits, and the creativity of these scams has sometimes shocked and surprised us.”

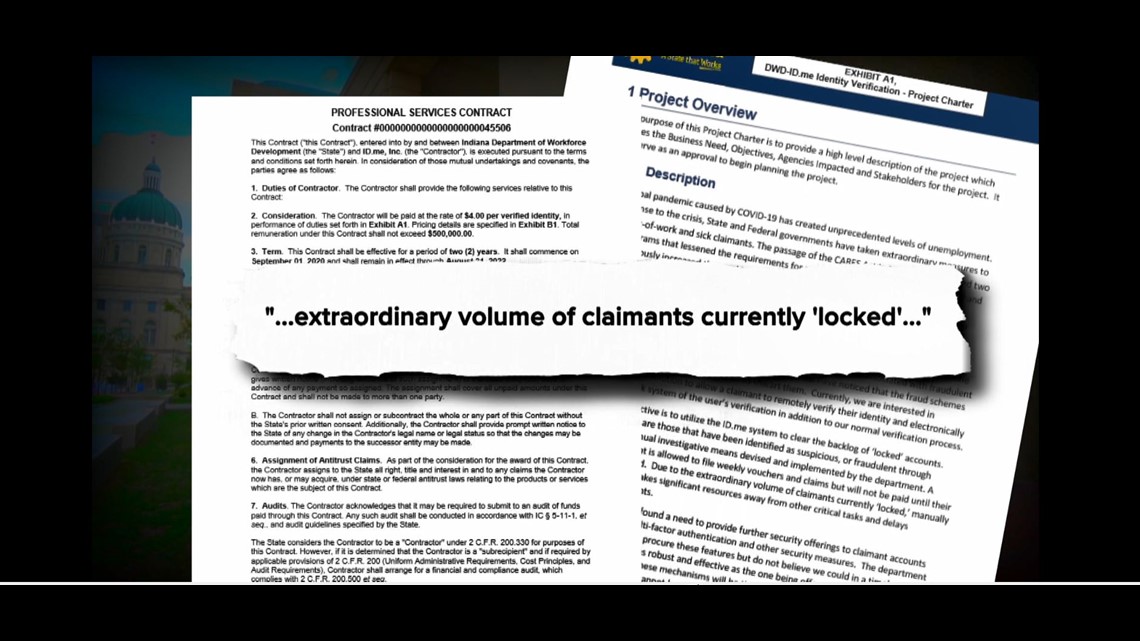

13 Investigates also obtained the agency’s $500,000 contract with ID.me, signed in November to reduce the state’s high rate of unemployment fraud. In the contract, DWD admits “the fraud schemes have evolved in concert with our efforts to thwart them,” and the massive problem has led to an “extraordinary volume of claimants currently locked” out of their accounts.

How Indiana is battling unemployment fraud

The lockouts are DWD’s way of trying to fight back against scammers.

The agency began implementing multiple steps last summer to address fraud. DWD’s recent fraud webinar for employers acknowledged Indiana now uses enhanced data analytics to recognize common fraud patterns, information sharing with state and federal law enforcement, participation in the National Association of State Workforce Agencies’ Integrity Data Hub to identify suspicious individuals and to cross-match information, as well as other security steps designed to reduce unemployment fraud.

One of the most effective strategies has been to hire Hall’s identity verification company. By late fall, Indiana DWD followed the lead of states like Florida, Georgia, Nevada and Arizona by hiring ID.me to provide more effective identity verification. The verification process requires unemployment applicants to show documentation – sometimes even engaging with online representatives by holding their driver’s license photo next to their face during a video chat – to prove their identity.

“Pretty much all our claimants have to verify their identity through this identity verification service before they can get paid now,” DWD director of unemployment insurance compliance Eryn Craven explained during last week’s webinar discussion with employers. And she said the $500,000 Indiana is spending for two years of verification service appears to be paying off.

“We’ve noticed a huge return on investment with ID.me in the past few months,” Craven added.

Hall, whose identity verification service is now used by 14 state unemployment agencies and the federal government, told 13News his company has helped states save billions of dollars since the start of the pandemic. That figure is based on the numbers of bogus claims identified and fraudulent payouts thwarted.

The ID.me executive said the verification process has caught scammers trying to hold up a photo of someone else in an effort to fraudulently pass an identification screening. It regularly detects con artists trying to submit an unemployment claim for a U.S. citizen while they are using a computer or cell phone thousands of miles away in foreign countries. And the verification process quickly flags accounts that change a cell phone number or bank account number immediately after passing verification.

“From what I’m seeing and from the audit we’re doing … it looks like the fraud rate is about 40 percent if not higher,” Hall said. “We’re blocking about a billion dollars in fraud per week. In California alone, we’ve blocked $9 billion in fraud.”

The savings are significant, but they also come with a cost.

“Locking out” people who need help

When DWD identifies a suspicious claim – either through ID.me or through one of its other fraud detection tools – the agency freezes all activity on that account. The freeze immediately stops the fraud while DWD conducts an investigation.

In its webinar for business leaders, DWD explained, “We’re revoking the accounts of alleged victims pending a formal investigation to confirm the ID theft once we receive notification. Revoking the account prevents access to the account and future payments from processing.”

The problem is DWD investigations can take 12 to 16 weeks to conduct – in some cases, much longer – because the agency is swamped with a huge backlog of investigations and limited staff to conduct them.

A 13News investigation revealed 1,256,463 of the unemployment claims filed by Hoosiers who were unemployed during the weeks ending March 7 through Oct. 3 were still classified as “pending” in late October. That same investigation showed hundreds of contracted workers hired by DWD to handle calls from people who filed for unemployment are not trained in how to resolve pending claims. The state says some of its backlogged claims are pending due to showing signs of fraud, but DWD did not elaborate on the actual number. 13 Investigates has requested more updated data from the state to show its current number of backlogged claims, but DWD has not yet provided that information.

Despite increasing its workforce from 436 employees before the pandemic to more than 1100 workers in November, DWD acknowledges that it is still struggling to keep up with investigating and resolving fraudulent unemployment claims. “We are very backlogged in our investigations right now,” Craven confirmed last week.

Multiple identity theft victims have told 13News they repeatedly sent extensive amounts of identity verification documents to DWD (at the agency’s request), only to be told the documents never arrived.

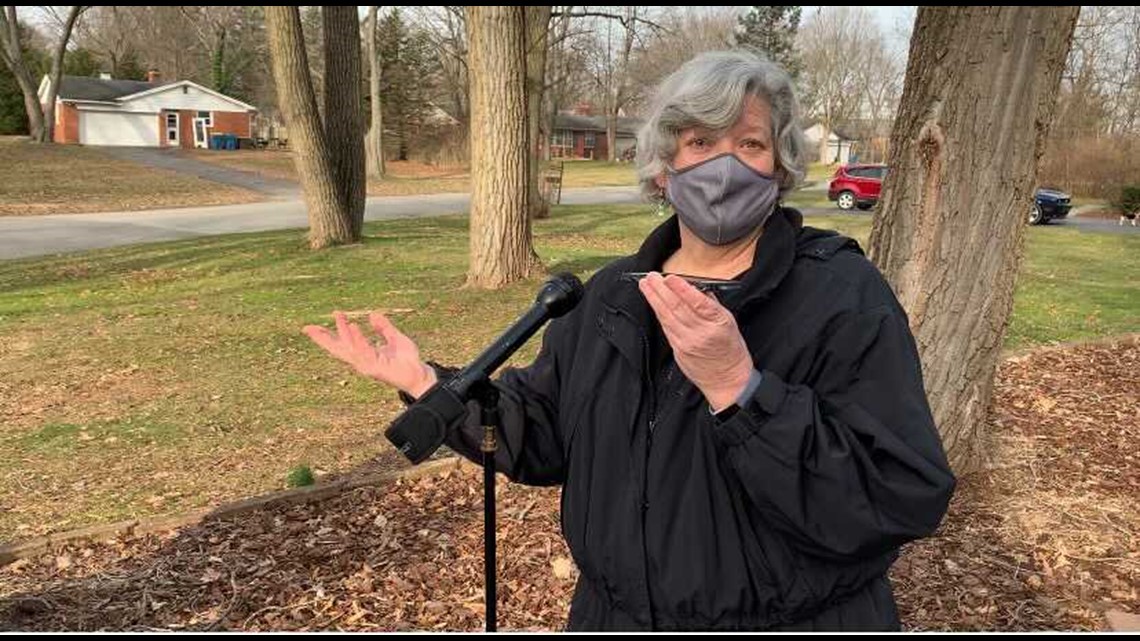

“I sent my driver’s license, my social security card, my license to carry [permit]. I sent my passport, my birth certificate, I sent my W2. Other than that, I don’t what else I can send them unless they want a blood sample,” Yvonne said, shrugging her shoulders. “All that and they still wouldn’t unlock my account.”

Yvonne and Erin were both locked out of their DWD accounts for months – not because they are scam artists, but because they are victims of scam artists. And because of that, the state would not allow them to apply for the unemployment benefits they are entitled to receive.

“When I finally got the [DWD] person on the phone to tell me someone else got into my account and it was identity theft, he told me ‘The problem now is you’re going to have to prove you’re who you say you are,’” Yvonne recalled. “That’s what I’ve been dealing with ever since.”

Frustrated and angry, Erin contacted the governor after waiting 13 weeks for DWD to unfreeze her unemployment account.

“I felt the governor was responsible for how things were running, and it wasn’t running well,” she said. “I’ve got to do something, and if nothing else, scream and yell until someone pays attention.”

Erin said an aide at the governor’s office provided her with a contact at DWD, who then gave her a phone number for a DWD investigator who was handling her case. Over the coming weeks, Erin said she left a voicemail message with that investigator daily.

After more than two dozens attempts and no return phone call, Erin gave up. She decided to call 13News instead. Yvonne also asked 13News for help after months of unsuccessful attempts to resolve her locked unemployment account.

13News contacted DWD to ask about these cases. One day later, the agency unlocked Erin’s account. It took two days to unlock Yvonne’s unemployment account. For the first time since losing their jobs, the women could start applying for unemployment benefits.

13 Investigates has intervened in numerous other situations involving victims of unemployment fraud whose accounts were frozen by DWD for months, only to be quickly unlocked once 13News asked DWD to investigate. In other situations, fraud victims continue to wait for the state to take any action at all.

One of those cases involves Katrina Bates, a disabled U.S. Army veteran who cannot collect unemployment in her home state of Maine because she is the victim of identity theft and unemployment fraud in Indiana. For months, she has tried unsuccessfully to get DWD to respond to her emails and phone calls.

“The state of Maine has requested information from Indiana several times about this claim so they could process mine here… Indiana has not answered any questions from Maine nor myself,” Bates wrote in a desperate email to 13News. “If I cannot get any help soon I won’t have the ability to keep the lights on, keep my family warm or enough food on the table. This shouldn’t be happening.”

“Broken” system fails to warn victims

While Yvonne and Erin feel relieved that their own accounts are now unlocked, they are determined to speak out to help other victims who have not yet received a response from DWD. They are furious the department waited so long to take action on their cases — only doing so after being contacted by an investigative reporter. And they say DWD is actually revictimizing the very people the agency is supposed to help.

“If this happened to them, and they were being treated this way, how would they take it?” Yvonne asked. “Somebody needs to be accountable.”

And they women are concerned the state agency never contacted them to warn their identities had been stolen.

Ten weeks passed before Erin learned someone had used her Social Security number to file a bogus unemployment claim. Erin also discovered her identity had been stolen to file fraudulent unemployment claims – in Pennsylvania and Indiana – months before she ever tried to file a claim herself. They say DWD never attempted to contact them, even after the state agency flagged their accounts for suspicious activity.

While DWD does have information on its website to offer general warnings and advice about unemployment-related fraud and identity theft, the state of Indiana has no system to alert Hoosiers who are victims of unemployment fraud. Asked multiple times to explain what steps the state of Indiana takes to contact victims of unemployment fraud when detected by DWD, both the agency and governor’s office declined to answer that question.

“I would have never had a clue that anybody had my stuff out there because nobody ever reached out to me, and that’s scary,” Yvonne said. “Unless something happens and you can figure it out on your own, you’ll never know.”

“The system is just broken. It’s just broken, and there have to be a lot of other people besides myself that are going through this same thing, but they don’t even know it yet.”

And what you don’t know can indeed hurt you. Perhaps the most unsettling part of this widespread unemployment scam: you can be a victim even if you never applied for unemployment.

Anyone can be a victim — even an investigative reporter

Like Erin and Yvonne, my Social Security number and personal information was also stolen by scammers, who used it to open unemployment accounts and apply for benefits in three separate states.

My first warning sign was a debit card I unexpectedly received in the mail. It is from US Bank, and when I called the bank, I learned it had been sent to me because I had applied for unemployment benefits in the state of Ohio. Of course, I had not.

ODJFS confirmed someone had used my name, address, former phone number, date of birth and Social Security number to submit several PUA claims in October totaling $8,694. The state had already paid $1,746 of those benefits – not to the debit card I had received, but to a Wells Fargo bank account the scammer had set up in my name. The ODJFS staff member I spoke to said the state was getting ready to make another payment to that bank account when I called to inform the agency that I have never applied for unemployment benefits in Ohio.

Less than a week later, I received another unexpected US Bank debit card in my mailbox – this time from the state of Colorado. A representative from that state’s unemployment office told me a PUA claim had been filed in early November using my name, address and Social Security number, along with a phone number and email I had never seen before.

Now sensing a sick feelings in the pit of my stomach, I wondered if my identity had been used to apply for PUA benefits in Indiana. I looked at the DWD website and attempted to set up an account, figuring it might allow me to speak directly with a fraud investigator. But when I tried to set up a general account, the DWD website told me I had already created one and was now entering the incorrect password. My suspicion was correct. Someone opened a DWD account using my name, address, work address and Social Security number in mid-September. Whoever created the account had not yet filed any vouchers, but a DWD customer service representative told me it was likely just a matter of time.

I was amazed to learn I could be a repeated victim of unemployment fraud without ever filing a claim for unemployment.

After the reality set in, that’s when the work began.

It took me about eleven hours to get ahold of all three state unemployment offices to report the fraudulent claims and accounts in my name; to contact the Equifax, Transunion and Experian credit bureaus to initiate a year-long credit freeze; to speak with law enforcement agencies in all three states and to file a police report in Indiana; to file a stolen identity report with the Federal Trade Commission; and to reach US Bank and Wells Fargo to deactivate the debit cards and fraudulent bank accounts opened in my name.

Yes, it was exhausting. But I was lucky. Unlike Yvonne and Erin, I was doing all of that while still employed.

Below you will find some tips and resources I discovered along the way.

The warning signs that you might be a victim of unemployment fraud

Because unemployment-related fraud and identity theft is so widespread, you or someone you know might already be affected without realizing it yet.

Here are some of the warning signs and how you can find out:

- Be wary of an unexpected debit card. Some states automatically send out a debit card when an applicant for unemployment benefits is approved to submit claims. If you did not request a debit card, call the number on the back of the card to ask the issuing bank why you received it. (Be aware that the IRS is sending some stimulus payments by debit card. To see what that debit card looks like, look here.)

- Try to create a general account with your state unemployment office. If the online system won’t let you set up an account or it says the password on a new or existing account is wrong, that’s a red flag.

- Watch for a 1099-G tax form. In most states, unemployment benefits are taxable. So if you get a 1099-G tax form in the mail and you didn’t apply for unemployment, it’s probably a sign of fraud.

What to do if you are the victim of unemployment fraud identity theft

If your identity is stolen and used by someone else to open an unemployment account or to file an unemployment claim, act quickly to prevent the potential of additional financial impact. The Federal Trade Commission and state unemployment suggest you take the following steps:

- Contact the unemployment office(s) where a fraudulent claim was filed using your personal information to report the fraud. Some state agencies prefer for you to file an online report, which should be provided on the departments’ websites.

- Contact the three major credit bureaus (Equifax, Experian and Transunion) to place a credit freeze on your credit, which will prevent anyone from using your Social Security number to open a new financial account or loan without your permission.

- File an identity theft report with the Federal Trade Commission. The FTC tracks the number of cases and identity theft trends nationwide to issue public alerts.

- File a police report with your local police department. If the identity theft involves significant financial impact, banks and creditors may require you to present a police report to legitimize your claim of fraud. Police can also track trends and, in some cases, investigate and seek criminal charges against those responsible

How to file an unemployment fraud report in Indiana

The Indiana Department of Workforce Development says victims of identity theft-related unemployment fraud should take these five steps specific to Indiana:

- Fill out State Form 57068 and mail or fax it to the department. Upon receipt of this form, DWD will lock the account from further use and initiate an investigation and issue a determination. Here is the mailing address and fax number:

Department of Workforce Development

10 North Senate Avenue

Indianapolis, IN 46204

Fax: (317) 633-7206

- File an electronic report with the Indiana State Police by filling out the form available at https://www.in.gov/dwd/indiana-unemployment/fraud/ and emailing it to uifraud@isp.in.gov.

- If you are currently employed, contact your employer’s human resources department so that they can protest your claim with DWD

- Use these resources to file other reports:

- File a report with the Federal Trade Commission at www.ftc.gov

- File an Identity Theft Affidavit (IRS form 14039) through https://www.irs.gov/

- Notify the Credit bureaus (Equifax, Experian, and TransUnion)

- The FBI also encourages victims to report fraudulent or any suspicious activities to the Internet Crime Complaint Center at http://www.ic3.gov. You may consult http://identitytheft.gov for help in reporting and recovering from identity theft.

- File an identity theft complaint with the Indiana Attorney General’s Office at https://www.in.gov/attorneygeneral/2895.htm or by calling (800) 382-5516.

How to reach the Indiana Department of Workforce Development

Indiana DWD Benefit Call Center:

1-800-891-6499 (M-F 8:00 am to 4:30 pm EST)

DWD Mailing address:

Department of Workforce Development

10 North Senate Avenue

Indianapolis, IN 46204

DWD Fax:

(317) 633-7206

DWD emails:

Commissioner Fred Payne - FPayne@dwd.IN.gov

Chief of Staff Josh Richardson - JRichardson@dwd.IN.gov

Chief Communications Officer Bob Birge - RBirge@dwd.IN.gov