INDIANAPOLIS (WTHR) – 2020 is now just a few days away, and with a new year comes new changes in tax law.

The Tax Cuts and Jobs Act of 2017 brought sweeping changes to the tax code. Most of those changes took effect in 2018, but others phased in this year with a few additional changes set to kick in in 2020.

Here are some of the biggest changes that will impact your next tax return, and some steps you can take now to get a bigger refund check (or reduce what you owe) when tax time rolls around in the spring.

1. Higher retirement account contribution limits

This year, the IRS increased the amount you can contribute to your retirement accounts: up to $6,000 for IRAs and up to $19,000 for your 401K.

If you're over 50, the IRS allows you to stash even more in your retirement accounts. You have until April 15, 2020 to make your contribution for 2019.

Increasing the amount you put into your retirement accounts now will help boost your savings while also decreasing the amount you pay in taxes later.

2. New tax form for seniors

In 2020, seniors have a new tax form they can use. It's called a 1040-SR and it's meant to simplify tax preparation for those who are 65 or older.

3. No alimony deduction

If you are recently divorced and either paying or receiving alimony, the IRS will no longer factor those alimony payments into your tax returns.

That could make a big impact on what you owe or the refund you get.

The change took effect in 2019, meaning individuals who got divorced this year cannot write off alimony payments on their 2020 tax returns. Spouses who divorced in 2019 and who received alimony payments cannot consider those payments as income.

For divorce or separation agreements made before 2019, individuals can use the old tax rules as long as there are no modifications stating that the new rules apply.

4. No ACA individual mandate penalty

The Affordable Care Act's individual mandate expired this year, so if you didn't get health insurance in 2019, you will no longer have to pay a penalty when you file your taxes in the spring.

5. Higher threshold for medical expense deductions

When it comes to deducting medical expenses, Congress and the IRS made that harder this year.

If you itemize your tax deductions, you won't be able to write off eligible, out-of-pocket healthcare expenses unless they exceed 10 percent of your adjusted gross income. For the past couple of years, the threshold has been 7.5 percent.

Starting in 2019, it is now at the higher level.

6. Increased standard deductions

On the positive side, standard deductions are a little bit higher this year, increasing to $12,200 for single tax filers and for those who are married but filing separately. (That is up from $12,000 last year.)

For married couples filing together, the standard deduction increases to $24,400. (Up from $24,000 last year.)

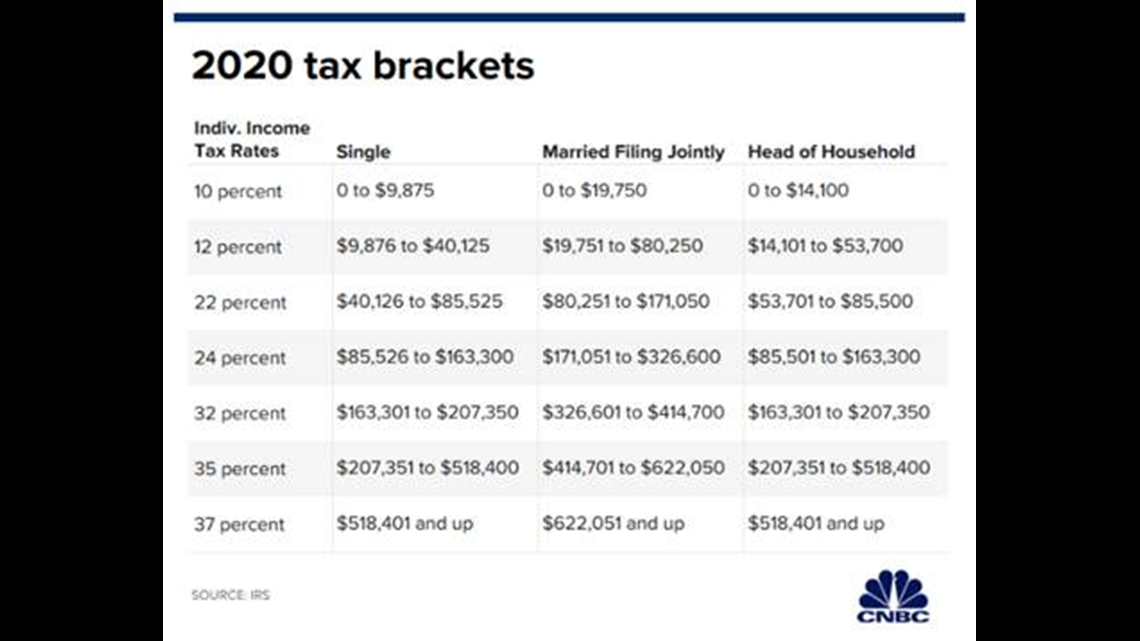

7. Higher income brackets

The income tax brackets also changed this year to account for inflation. There are still seven brackets – ranging from 10 percent to 37 percent -- that apply to adjusted gross income after you factor in your standard or itemized deductions.