INDIANAPOLIS — An Indianapolis business owner says his bank has now fully reimbursed him for several stolen checks following a 13News Investigation that exposed security problems involving mobile banking.

Robb Fine, owner of Fine Promotions, received a payment of $10,936.01 less than one week after 13Investigates showed how Indianapolis residents were caught up in the growing problem of mobile banking check fraud. It brings his total reimbursement to nearly $21,800 after thieves stole checks from the mail and cashed them without ever walking into a bank.

“Thank God this is all behind me now. I don’t think anybody understands what you go through with this kind of fraud and how damaging it is,” Fine told 13News.

Other victims are still battling their banks to recover money stolen from their accounts as financial institutions struggle to stop a trend that is now costing the banking industry more than a billion dollars each year.

The dark side of mobile banking

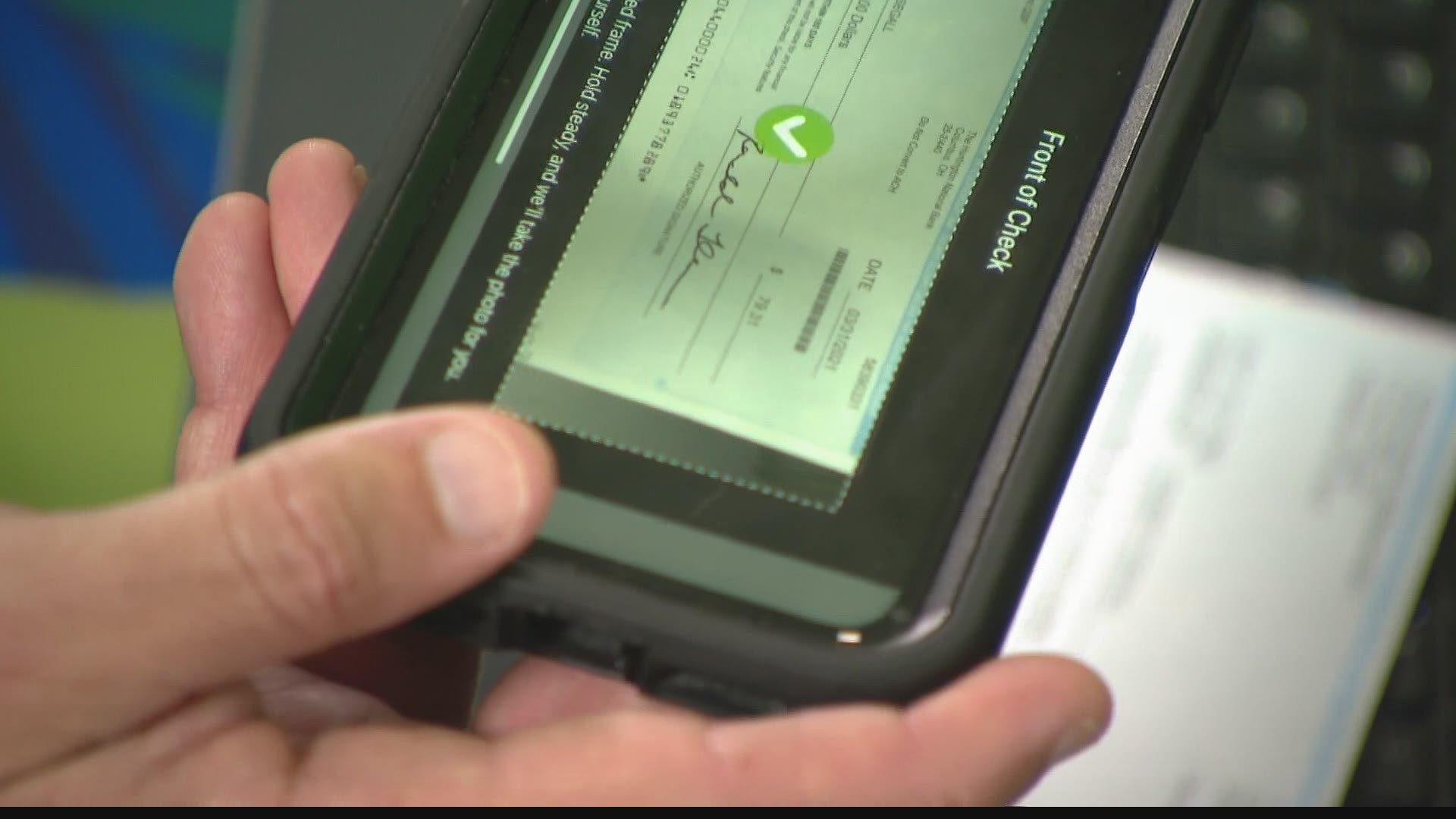

Millions of people now use handy mobile apps to deposit checks and transfer funds.

Since the start of the COVID-19 pandemic, mobile banking has skyrocketed. Last April alone, right after the pandemic started, new mobile banking registrations jumped 200%.

But consumers aren’t the only ones who enjoy the convenience of depositing checks by phone; criminals love it too.

13Investigates showed multiple instances in which thieves stole checks right out of victims’ mailboxes, then used mobile banking to deposit the stolen funds.

“It’s unreal that the world has gotten like this where you can’t even use your own mailbox,” said Mary Wilson, who had a check stolen out of her home mailbox on the northwest side of Indianapolis.

The banking industry has plenty of security tools to catch check fraud, and an industry trade group says those tools help banks catch nine out of every 10 check fraud attempts. But security analysts told 13News many smaller banks try to save costs by not investing in that security. And even larger banks that do use the technology to detect check fraud usually do not scan every check deposited via mobile banking.

It means many checks that show blatant signs of fraud still get through. Since would-be fraudsters no longer need to visit a bank or ATM to deposit a check, mobile check fraud is easier and less risky than ever.

“It’s not that difficult. It’s actually pretty easy to do,” said John Ravita, the marketing director for SQN Banking Systems, which provides counterfeit and forgery protection software to the banking industry. “I think the challenge with mobile banking is it’s faceless, so it is easier for a fraudster to perpetuate the fraud.”

“No question, what makes it easy to happen is the online app the bank gives you,” Fine said.

While Fine has been fully reimbursed by his bank, Harold Wilson is still waiting. The owner of Wilson Water and Sewer on the south side of Indianapolis had four checks stolen from his business totaling more than $12,000. His bank has returned much of the money, but Wilson is still waiting on $2,800 in reimbursement for checks that were stolen more than nine months ago.

“They used the mobile banking to cash those checks. That’s how they did it, and they changed the amounts and the signatures and everything. We still don’t have that money back,” Wilson told 13News.

Criminal investigations are ongoing in each of the Indianapolis cases to figure out who stole the checks, but the victims want banks to add more security to help prevent the crimes from happening in the first place.

“It’s so easy for the crooks to steal the money using the mobile app. They’ve got to make it harder,” he said.

How to protect yourself

Criminals can create a fake check and target your bank account simply by getting your personal information or by getting ahold of one of your checks. The American Bankers Association offers the following advice to help reduce your risk of being a victim of mobile check fraud:

- Don’t share your information

Don’t provide your Social Security number or account information to anyone who contacts you online or over the phone. Protect your PINs and passwords and do not share them with anyone. Use a combination of letters and numbers for your passwords and change them periodically. Do not reveal sensitive or personal information on social networking sites. - Shred sensitive papers

Shred receipts, banks statements and unused credit card offers before throwing them away. - Monitor your accounts regularly

Rather than waiting for your monthly statement, use online banking to monitor transactions on your account regularly. If you see a fraudulent transaction, notify your bank immediately. - Sign up for text alerts

Sign up for text or email alerts from your bank for certain types of transactions, such as online purchases or transactions of more than $500. - Protect your mobile device

Use the passcode lock on your smartphone and other devices. This will make it more difficult for thieves to access your information if your device is lost or stolen. Before you donate, sell or trade your mobile device, be sure to wipe it using specialized software or using the manufacturer’s recommended technique. Some software allows you to wipe your device remotely if it is lost or stolen. Use caution when downloading apps, as they may contain malware and avoid opening links and attachments – especially from senders you don’t know. - Keep tabs on your mail

Fraudsters look for monthly bank or credit card statements or other mail containing your financial information. Consider enrolling in online banking to reduce the likelihood of paper statements being stolen. Also, don’t mail bills from your own mailbox with the flag up. - Monitor your credit report

Order a free copy of your credit report every four months from one of the three credit reporting agencies at annualcreditreport.com. - Protect your computer

Make sure the virus protection software on your computer is active and up to date. When conducting business online, make sure your browser’s padlock or key icon is active. Also look for an “s” after the “http” to be sure the website is secure. - Enable Multi-Factor Authentication

In addition to guarding sensitive financial information, we highly recommend consumers enable multi-factor authentication as one of the highest levels of protection against their account being hacked. - Report any suspected fraud to your bank immediately