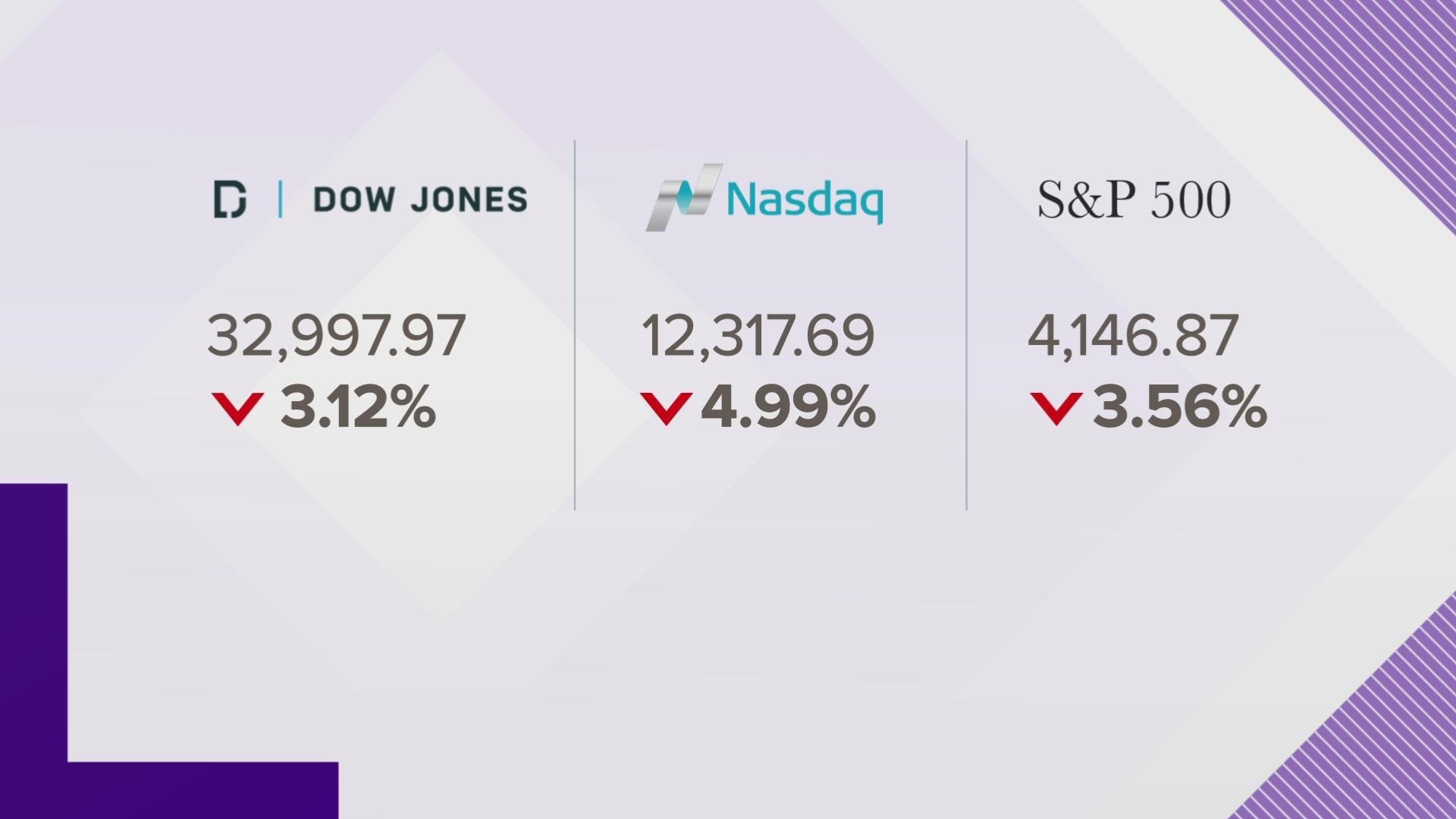

INDIANAPOLIS — The stock market doesn't like uncertainty. So when things look murky down the road, the ticker shows it.

Dr. Larry Belcher with the University of Indianapolis said what's being priced in is what's going to happen to companies earnings and things like that in the future.

"When there's uncertainty about that, then you tend to get volatility. And you have people that react to changes in conditions, so you may have sell-offs," Belcher said.

When it comes to why this is happening, there are a lot reasons.

RELATED: Why did stocks fall on Wall Street?

One of the reasons: more lockdowns in China.

Just as shipping issues began improving, Shanghai — the world's biggest container port — went under lockdown.

While the lockdowns are easing now, it's still going to cause supply chain issues. Those supply chain issues cause fewer items to go out, contributing to inflation.

"You got 8.5% inflation. You got wage growth, but it's not keeping pace. So I think there's a lot of those kinds of contrasts that you see in the data. And those things also feed into how the markets react," Belcher said.

There is also the turmoil between Ukraine and Russia. The straw that could have broken the camel's back? The Fed hiking interest rates Thursday.

That's a move they made to try and slow down inflation.

But despite all of this going on, it's important not to let your emotions make the decisions.

"You really need to be thoughtful, and know that this too will pass at some point in time. What's your long-term planning horizon look like?"

That planning is often dictated by your age. If you have concerns, talk to your advisor first.