INDIANAPOLIS — Most of us like saving money.

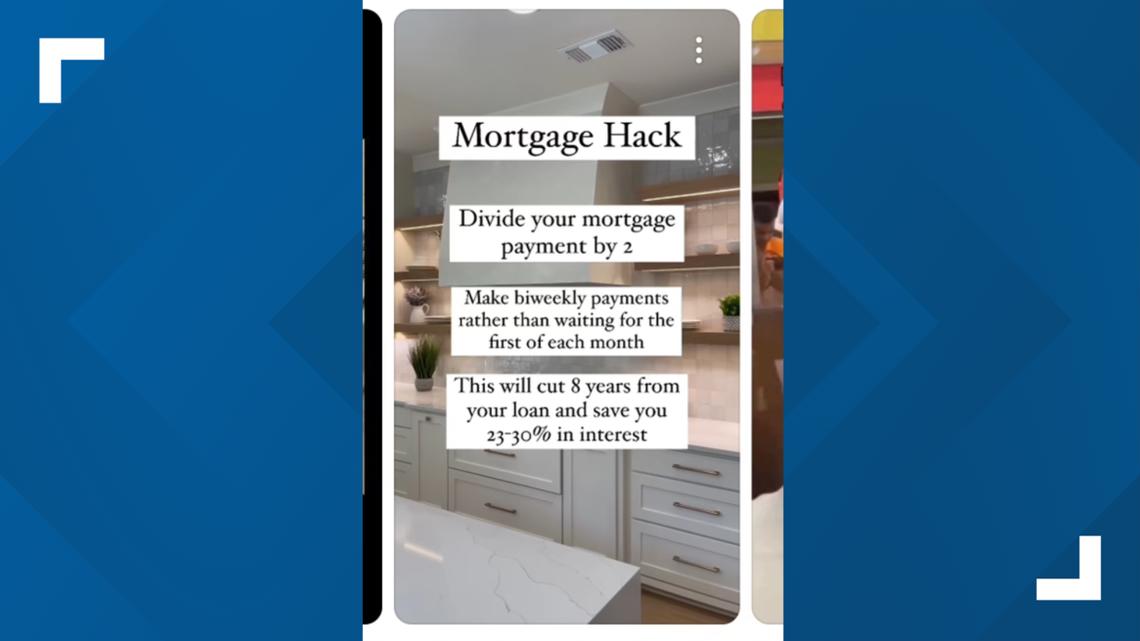

So, when 13News saw a social media post claiming a hack could trim money and time off of your mortgage, we checked it out.

The post says, “Divide your mortgage payment by 2. Make biweekly payments rather than waiting for the first of each month. This will cut 8 years from your loan and save you 23% - 30% in interest."

To see if that statement is true, 13News reached out to loan officer Audrey McClelland with CrossCountry Mortgage Carmel.

"Yes, making biweekly payments can help you save over the life of the loan," McClelland confirmed.

She said splitting your mortgage payment in half and paying it every two weeks comes out to about an extra payment annually.

"A lot of people are like, well, can I just throw in one extra payment instead? And the answer is yes. That will still take some life off of your 30-year mortgage," McClellan explained, "but by doing the biweekly payments, you're actually going to keep ahead of that interest faster."

Let us take a $475,000 loan at a 7% rate for a 30-year term.

If you pay your $3,160 mortgage once a month, the interest will cost you $662,667 over the life of the loan.

If you split that payment in half, paying $1,590 every other week, the interest will cost closer to $493,000 over the life of the loan and shorten it the term to about 24 years.

That could be a savings of almost $169,000, or roughly a 25% discount on your interest, just like the post claims.

This payment schedule is also worth a conversation with your lender.

Make sure your math matches their math and double check your loan type for any possible pre-payment penalties.