INDIANAPOLIS — Saving for retirement is a process that can work like a roadmap.

Dr. Larry Belcher, with the University of Indianapolis, said the first thing to do is to start thinking about where you are at and where you want to be.

"It's intimidating, but that's where the power of doing research, and the power of talking to people can really be helpful," Belcher said.

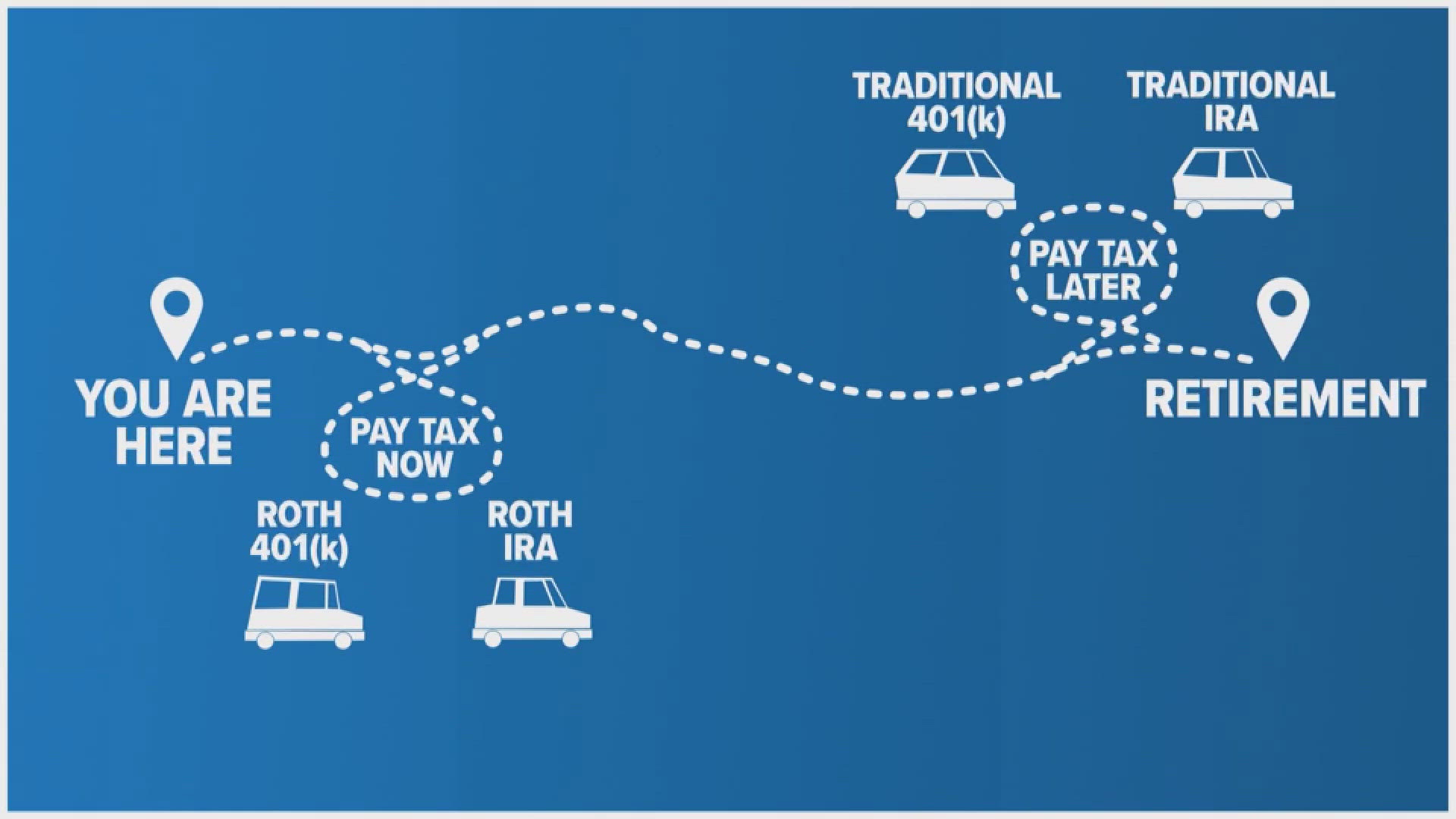

To get to your destination, there are different types of retirement accounts, or vehicles. Just like you can have more than one vehicle, you can have more than one retirement account.

"The reason why they exist is because we're different. So, we're at different stages of life. We have different risk tolerances," Belcher said.

A Bankrate survey found 56% of Americans feel behind on saving for retirement.

That is why it is important to take a look at your life from the money you are spending to the money you are saving. 401(k) accounts are retirement plans you can get through work, and Individual Retirement Accounts (IRA) are plans you can get on your own.

Each account type can have another option — Roth or traditional.

For Roths, you pay taxes now. For traditional, you pay taxes later.

If you are unsure what questions to ask or talk about with an advisor, Belcher has a few suggestions.

"Explain what a required minimum distribution is," Belcher said. "Explain the difference between pre-tax and post-tax dollars. How does that impact me?"

It is also important to understand the fee structure: How much are you paying a person or company to manage the funds?

That way, you can avoid wrong turns on your road map.