INDIANAPOLIS — Fitness is Jason Shaw's passion.

"It's always been something that helps me just regulate my life," Shaw said.

He works out six days a week, leads fitness groups, he even owns a gym.

That's why a heart attack when he was 39 years old came as a surprise.

"I was on a run, running up the stairs of the War Memorial. And I started to feel some chest pains," Shaw said.

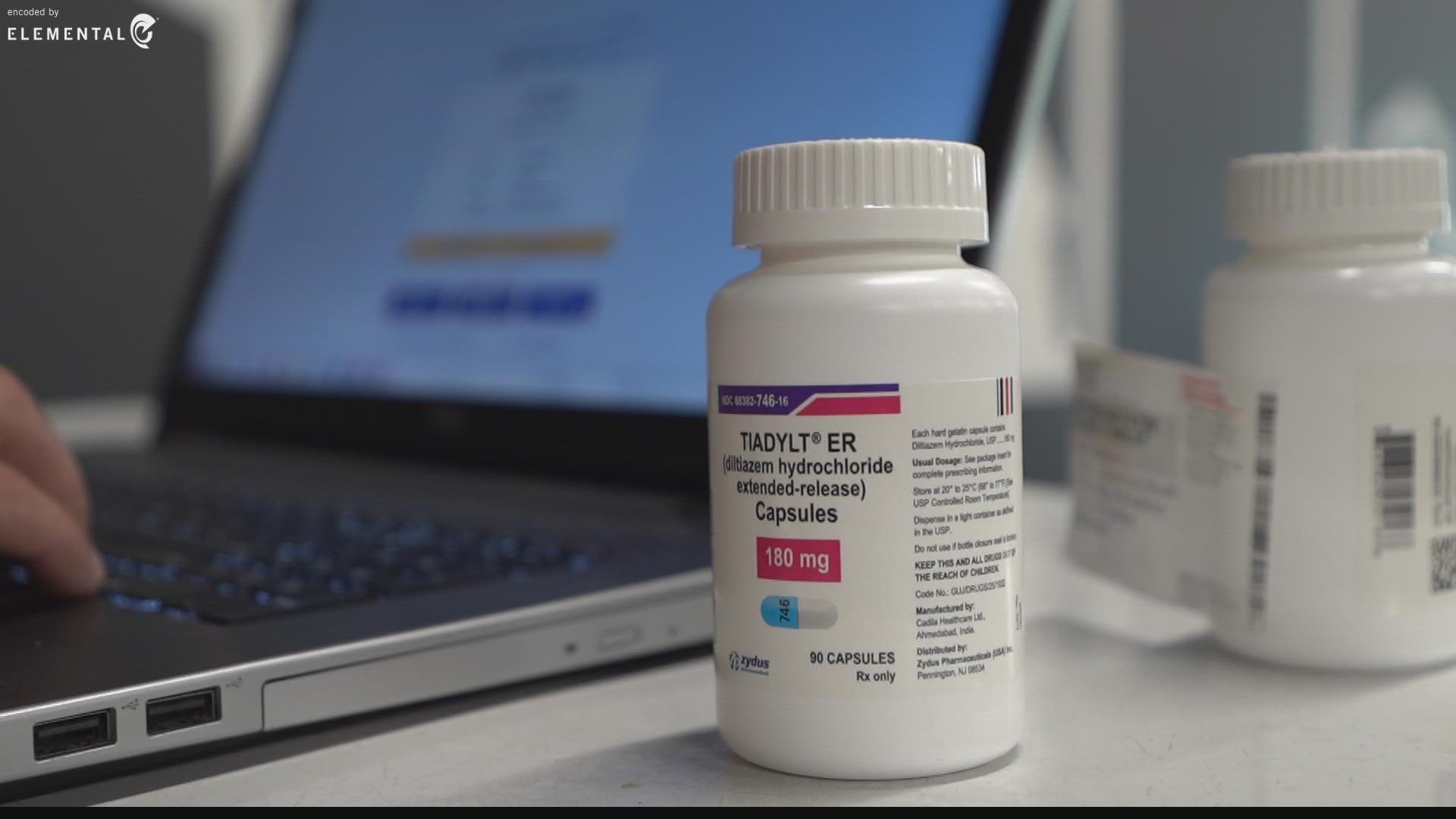

After open heart surgery to correct "the widowmaker," Shaw learned he would likely need to pay for certain medications for the rest of his life.

"Originally, I just thought with the insurance rates that the pharmacy gave me, that was the best I could do," Shaw said.

Then, he started price shopping his medications, comparing the insurance rate to cash pay programs. Cash pay programs do not go through insurance.

Cash pay programs include discount cards like GoodRx, and online pharmacies including Amazon Prime and Mark Cuban's new company, Cost Plus Drugs.

Shaw said with insurance, a 90-day supply of generic Lipitor is close to $37.

With the GoodRx discount card, the same dose and the same number of pills is $14 at Meijer. On Cost Plus Drugs, it's almost $9, plus $5 for shipping.

"You have three different prices for the exact same thing you're getting," Shaw said.

And he's not the only one researching prices.

A study found that Medicare could have saved billions of dollars in 2020 if they bought their generic drugs at Mark Cuban's prices.

The Cost Plus Drugs website says their drug price is the cost of manufacturing, plus a standard 15% markup, $3 labor cost and shipping.

Transparency that Shaw said he appreciates.

"It's nice to be able to shop around and do some research, and find exactly what kind of deal you can get. Because otherwise, if you just take their word for it, you're going to be paying a lot more than you should," Shaw said.

Before buying your prescription, compare prices using your insurance discount, a cash pay discount card like Good RX, and a cash pay online pharmacy like Amazon or Cuban's company, Cost Plus.

Just keep in mind if you've hit your deductible, it might make more sense to go the insurance route depending on your plan.