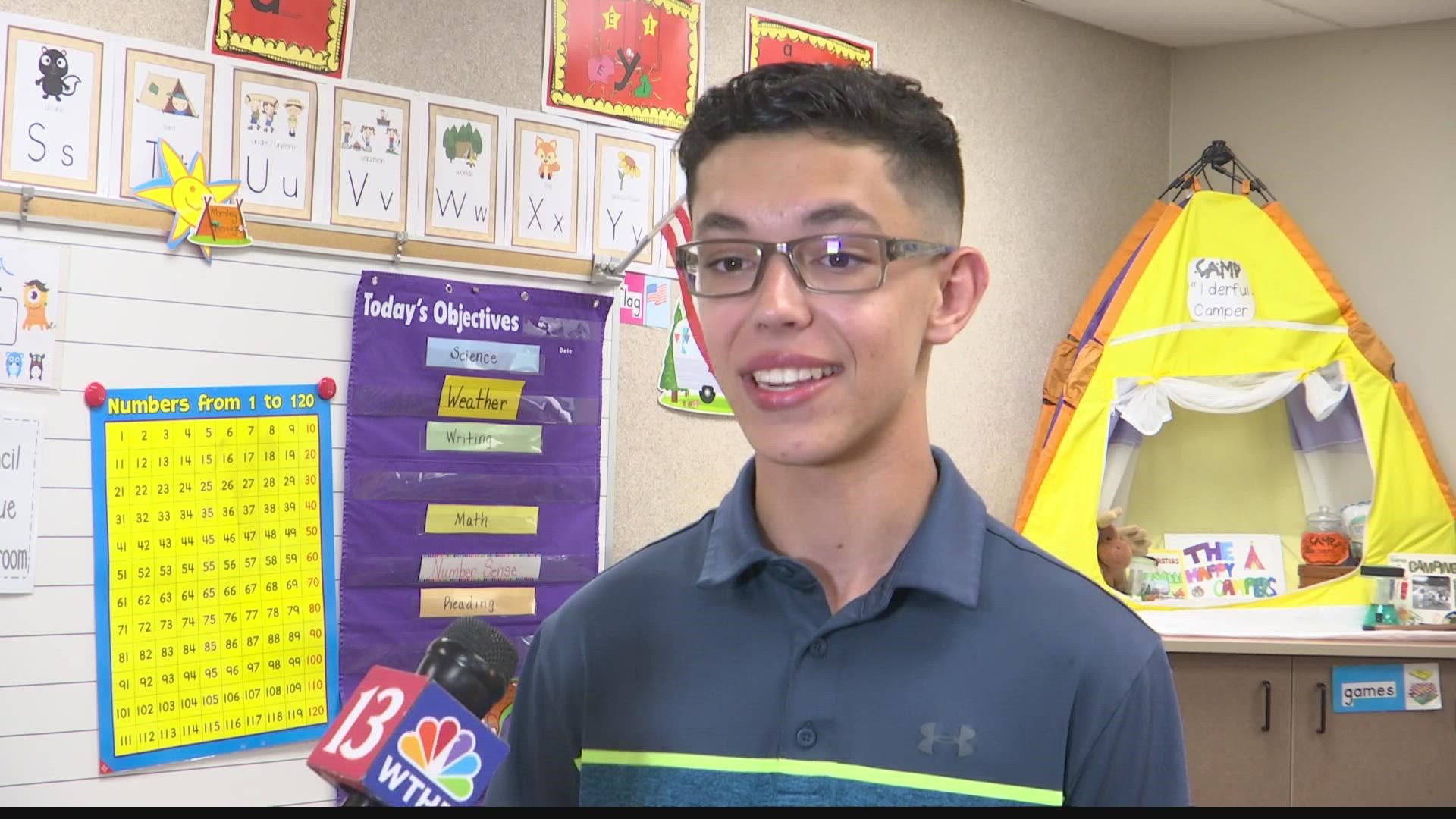

GREENCASTLE, Ind. — A Greencastle teen is building a more financially literate future for young people through his nonprofit.

Sixteen-year-old Isaac Hertenstein wants to help young people build a financially stable future. Like most leaders, he saw a problem in his community and he found a way to fix it.

"As a high schooler, two big things that a lot of people have conversations about are cars and college," said Hertenstein.

He noticed many students didn't understand what went into making those big purchases or their buying power.

"When it comes to college, we are taking out more college debt than ever. So, I think it's important to understand that and understand the options beyond college," said Hertenstein.

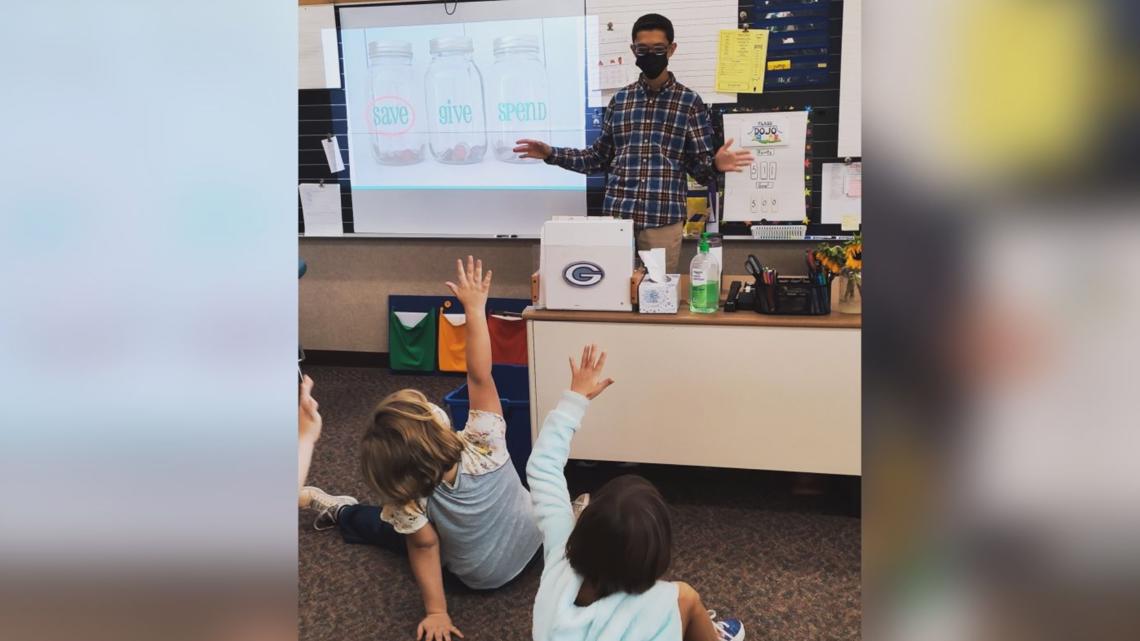

His nonprofit, Students Teaching Finance, is filling that gap and planting seeds of wisdom early in children from kindergarten to eighth grade. He's already taught more than 500 students in Greencastle.

"We are not one of the 13 states that require a financial literacy class in high school. We are kind of filling this need for both the communities and people's education. It really has a dramatic effect on financial literacy and their financial futures and health," said Hertenstein.

He believes having financial literacy courses in under-resourced communities like Greencastle is more important than ever.

"They're learning the basics of saving and spending and coming up with the mindsets for how to manage money at a young age," said Hertenstein.

One lesson he teaches to the younger students is that everything costs money, from water to electricity.

"Introducing these more grown-up topics kids don't know about at a young age, I think, is really important and introduces and plants these seeds for future financial knowledge," said Hertenstein.

He's now working on expanding his curriculum by establishing a team of high school students to teach kids about financial literacy in their own communities across the country.

"Hopefully in the future, we will teach financial literacy classes in high school that will enrich this so we will be financially literate adults," said Hertenstein.