INDIANAPOLIS — Tax prep services can be expensive to the tune of a couple hundred dollars.

That's why people like Samantha Hornung line up early to get their taxes filed for free at the Volunteer Income Tax Assistance program site.

"I arrived here by about 7:30 (a.m.)," Hornung laughed, "they didn't open till 10 o'clock."

VITA is a free, in-person tax prep service for households making $66,000 a year or less in 2022. It's an IRS program that United Way helps facilitate.

"This has been helping me the past few years," Hornung said.

Daniel Lee Mitchell is also a repeat customer who appreciates the money-saving program.

"Come down here and do your taxes for free. Keep that extra few 100 bucks in your pocket," Mitchell said.

He too lined up for the service before the John Boner Center opened its doors.

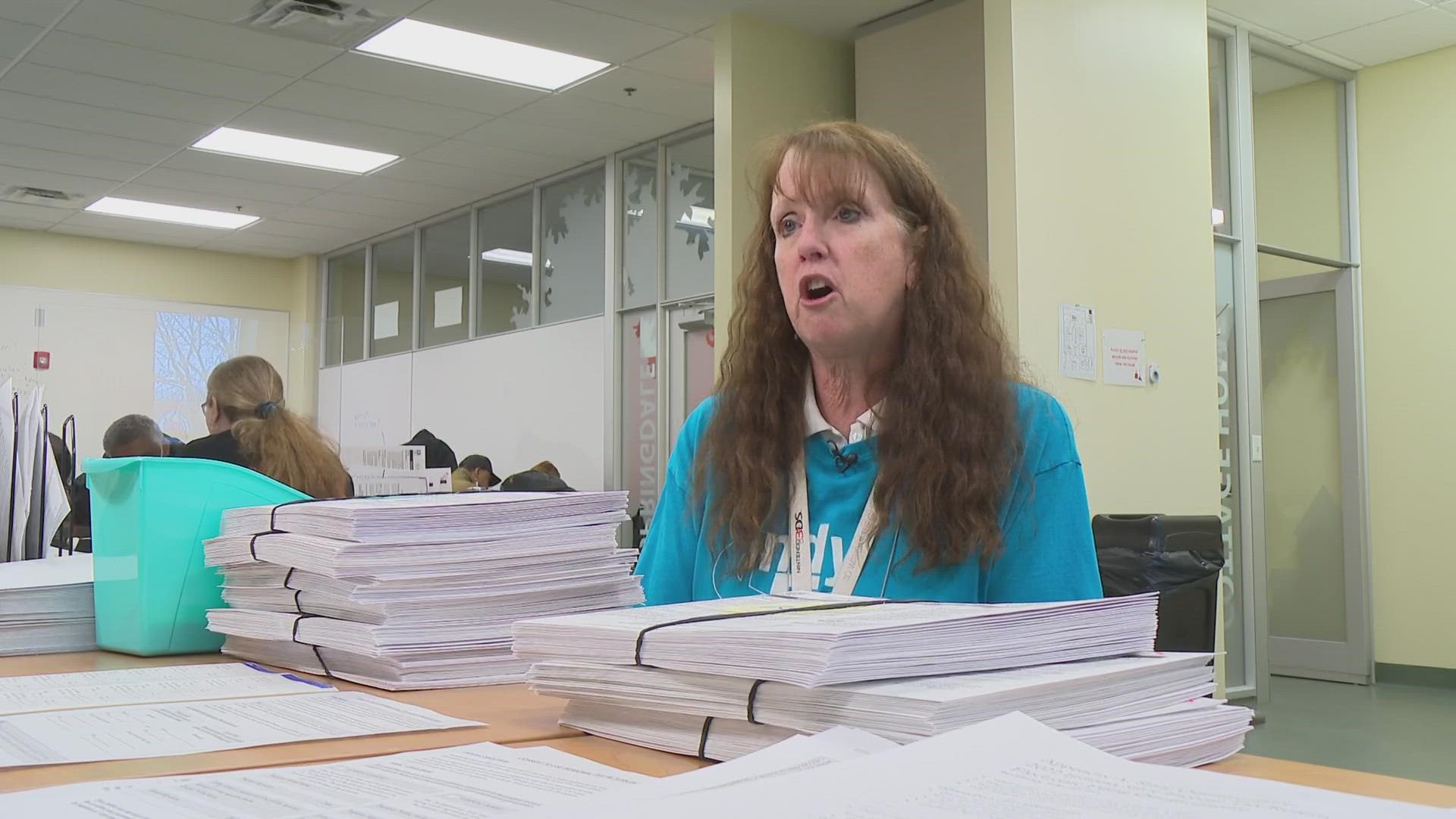

Rebecca Branson has been a VITA volunteer providing services for 30 years. She said every day, people come through their doors.

"So far this season, we have cut off every day with a full site," Branson said

In addition to VITA, the Tax Counseling for the Elderly is also available. TCE offers free tax help, particularly for those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.

While Branson said the Boner Center is the only walk-in location, there are many other tax centers where you can make an appointment.

Just don't forget your documents.

"The program requires a government-issued current ID and actual Social Security cards for anyone on their tax return. So if they have dependents or a spouse, we need Social Security cards for those individuals as well," Branson said.

Other documents include W-2 and your lease if you pay rent.

This year, free legal help is also being offered on site by the Neighborhood Christian Legal Clinic if issues come up.

"An example of that is where you've received letters from either the IRS or the state, and you're having trouble resolving what they're wanting," Branson said.

The deadline to file your taxes is April 18 this year because Tax Day, April 15, is a Saturday and Monday is a holiday.

The IRS says VITA will not prepare the following:

- Schedule C with loss, depreciation or business use of home

- Complicated Schedule D (capital gains and losses)

- Form SS-5 (request for Social Security Number)

- Form 8606 (non-deductible IRA)

- Form 8814 (child taxed at parent’s tax rate)

- Form SS-8 (determination of worker status for purposes of federal employment taxes and income tax withholding)

- Parts 4 & 5 of Form 8962 (Allocation of Policy Amounts, Alternative Calculation for Year of Marriage)