INDIANAPOLIS — If you need help filing your taxes, AARP volunteers will do it for free, even if you are not a member.

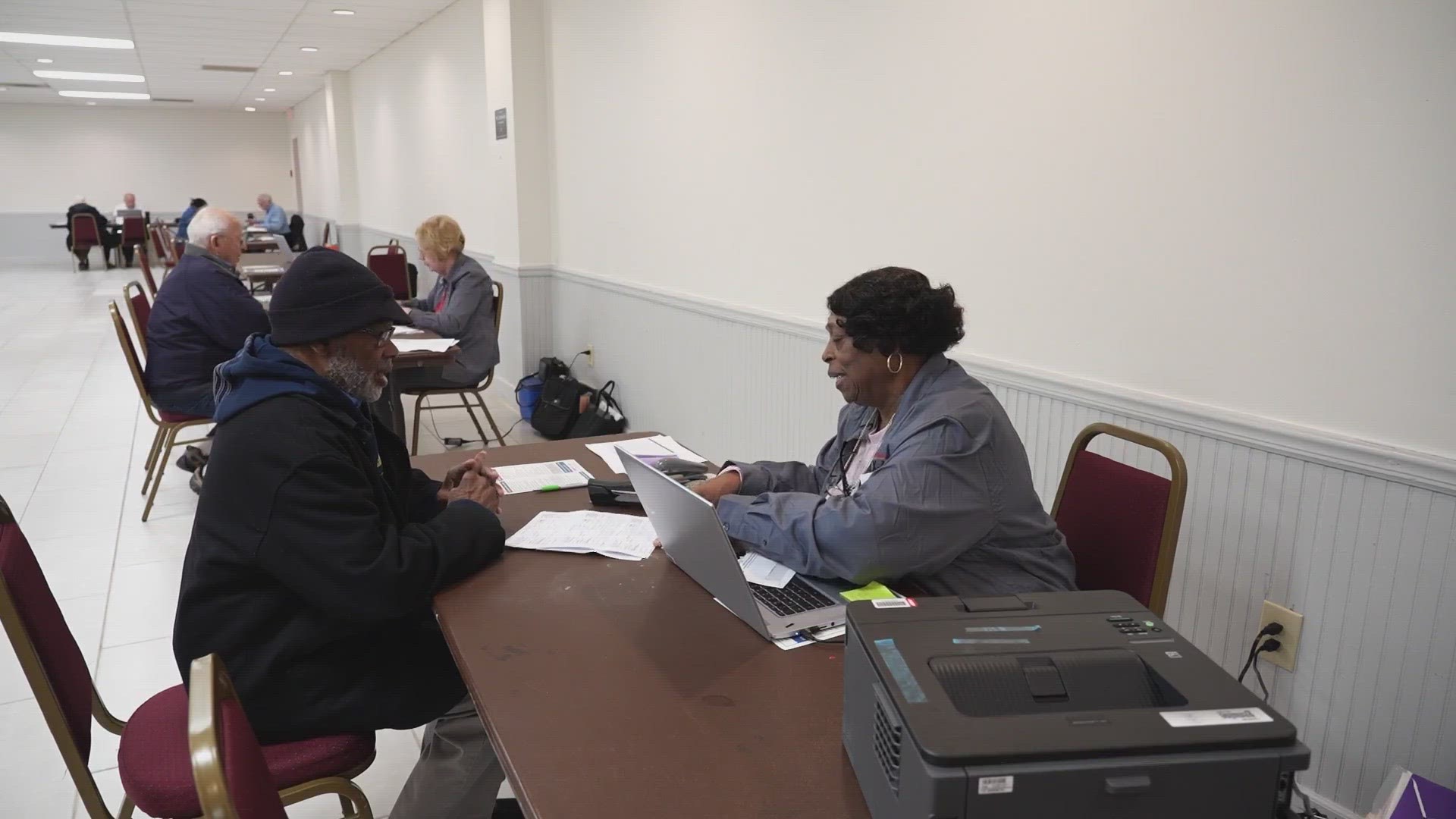

Toni Willis is one of the volunteers who has been helping people out for 17 years.

"Every year that I said, 'Oh, I just can't,' I find myself that I just can," Willis said.

And Willis can because she believes in the service she provides to others.

"It's more than just a service to the community, it's more of a ministry with me. I need to give back," Willis said

Francie Weber is grateful for Willis' assistance, too. This is Weber's sixth year returning for the free tax prep.

"I don't know how to do it myself," Weber said, "It's convenient. It's usually pretty quick."

In Marion County, the free tax prep is in different spots on different days of the week. On Tuesdays it's in Beech Grove, Thursdays are in Speedway and is held in Lawrence on Fridays.

All of those locations require an appointment.

While the program is aimed at people ages 50 and older, it's OK if you're younger.

There's also no income limit.

Willis said the tax forms just need to be simple.

"We don't do rental income, for instance, if you have rental property, we refer you to a paid preparer," Willis said.

They also won't accept complicated K-1 forms.

"We are not tax advisers. We are tax preparers," she said.

Before you head out the door, be sure you have your government ID, proof of Social Security for everyone on the return and any other tax documents.

That way, volunteers like Willis can get you in and out quickly.

Another free tax prep service is the Volunteer Income Tax Assistance Program, known as VITA. It’s an IRS program handled by United Way.

VITA's income limit is $66,000 per household.